It only went 5 or 6 feet into the air, before it came crashing back down to the ground.

So we tried again, running as fast as we could. But it still wouldn’t fly any higher than 6 feet before it fell back down to earth.

Last week I built a homemade kite with my 2 kids. We were in the backyard trying to make it fly, but there was very little wind – apart from the occasional light breeze that would barely shake a feather.

After about 20 minutes of the kids running as fast as they could with the kite bobbing up and down like crazy behind them, we gave up. It was disappointing, but we had to accept the conditions just weren’t optimal for flying a kite. We needed stronger and more consistent wind to push the kite higher. Without the right conditions, the kite was destined to keep crashing to the ground, no matter how hard we tried.

And we have often seen the same ‘kite crash’ problem in trading.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

We enter a trade, but the conditions aren’t right to keep the trade moving in the same direction, so the trade turns around and comes ‘crashing back down’. And it doesn’t matter how hard we try, if the conditions aren’t right we will likely keep getting the same result until the conditions change. Traders usually call these frustrating situations ‘false entries’ or ‘false breakouts’.

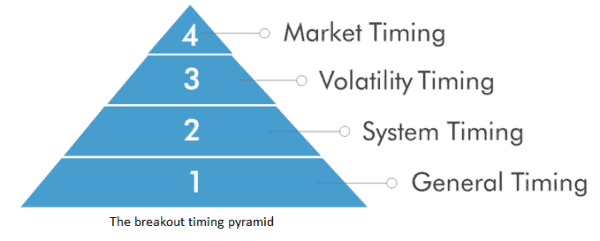

In fact, when we did a survey a few years ago asking traders what their #1 trading challenge was, the overwhelming response was ‘false breakouts’. That’s why we released the BTA ‘Breakout Timing Pyramid’, which shows the 4 levels of timing you can use to reduce false breakouts in your trading strategies.

In the last few months, we’ve been testing some new code we released in the ‘Smashing False Breakouts’ program, which contains 14 techniques based on the 4 levels of the Breakout Timing Pyramid.

And I’ve had some interesting results that I want to share with you.

The test strategy

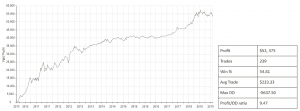

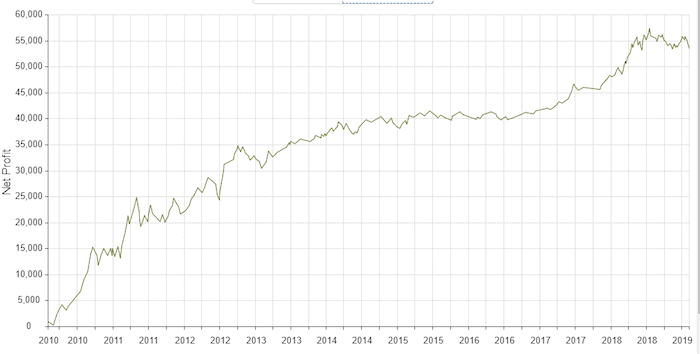

Here’s an actual trading strategy built using the process in the Breakout Strategies Masterclass. All results are Out of sample and exclude commissions, (which don’t matter for the purpose of this exercise).

The strategy is a swing strategy in the Wheat market, which can sometimes be a difficult market to trade. The strategy uses Trend and Volatility components across multiple timeframes to identify trades. Here are some key performance figures of the strategy over the 9 year period from mid-2010 to early 2019:

‘Higher Picture’ analysis

One of the techniques in the ‘General Timing’ stage of the Breakout Timing Pyramid is the concept of ‘Higher Picture’ analysis. This is where we look at trades in the context of the bigger picture, trying to identify the highest quality trades. It can be a very powerful technique in reducing and even removing the lower quality trades and improving overall performance.

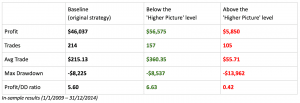

In this exercise, we’re going to add an additional filter to the Wheat strategy, which quantifies a ‘Higher Picture’ condition into a value, and then we’ll compare the results of trades when the ‘Higher Picture’ value is above and below a specific level. We’ll split the data into 2 periods:

- In-sample: 1/1/2009 – 31/12/2014,

- Out of Sample: 1/1/2015 – 1/1/2019.

First, let’s look at the In-sample results for above and below the level, and comparing the results to the baseline (original strategy) results:

Comparing the performance results of the strategy above and below the specific level, it’s clear the trades below the ‘Higher Picture’ level are higher quality trades, with a larger AvgTrade, Profit/DD ratio and reduced drawdowns. From this, it appears the ‘Higher Picture’ technique from the Breakout Timing Pyramid successfully reduced false breakouts in this case.

Trading below the ‘Higher Picture’ level

So, what happens if we only take trades below the ‘Higher Picture’ level and exclude them when they’re above? How will the strategy perform in the Out of Sample period?

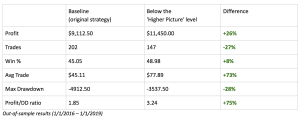

Here are the Out of Sample results comparing the baseline strategy with trades below the ‘Higher Picture’ level:

So the results show that in the 3-year Out Of Sample period, by only taking the trades that were below the ‘Higher Picture’ level, the strategy would have produced:

- 26% MORE profits,

- 28% LOWER drawdowns,

- 73% HIGHER AvgTrade,

- 75% HIGHER Profit/DD ratio,

- And all with a 27% REDUCTION in the number of trades!

From these figures, it’s clear that trades below the ‘Higher Picture’ level are better quality than the rest of the group.

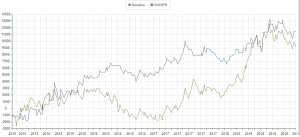

And comparing the equity curve for the OOS period only we can see that the equity curve for trades below the level (blue line) is smoother, with less pronounced drawdowns than the original strategy (green line):

Out-of-sample results (1/1/2016 – 1/1/2019)

So in conclusion, completing this type of ‘Higher Picture’ analysis can be incredibly helpful to identify the best quality trades, avoiding the low-quality trades and false breakouts. ‘Higher Picture’ analysis can be easily applied to any market or timeframe, and it’s just one of the 14 techniques we share in the ‘Smashing False Breakouts’ program.

If you want to discover more about how you can apply false breakout techniques to your own trading strategies, download the free ‘How to fix false breakouts fast’ guide here.

Andrew

PS. A few days after our original attempts at flying the kite, the wind picked up, so we tried again and the kite flew successfully – my kids were so excited with the result! :-)

Stop False Breakouts from Destroying Your Trading Account

✓ How false breakouts are the biggest leak of money for breakout traders, including Futures, Stocks, FX and ETFs

✓ How much money false breakouts could actually be costing you – without you even realizing it

✓ A comprehensive deconstruction of timing – enter breakout trades at the right time and stop costly breakout trading mistakes

✓ 4 proven approaches to slashing false breakouts today – stop them from stealing your money and eating all your profits!

![[VIDEO] What are you working so hard for?](https://bettertraderacademy.com/wp-content/uploads/2019/07/22.jul-FI-700px-min.png)