I have to admit, October was a challenging month.

I don’t know why, but it was the 2nd October in a row our hedge fund didn’t go well.

I even thought it had something to do with the DST time changes around the world. So I asked my team to do a thorough analysis of this phenomena, but we found NOTHING. Not a single bit of evidence that the DST time change should have a negative (or any in general) impact on our trading strategies long-term.

So I still don’t have the answer to this and I have to reconcile that it was just a coincidence, that OCT 2019 somehow was very similar to 2018…

But you know, it is part of the game.

We DO have losing months in trading and we have to get used to the fact that we will often have them.

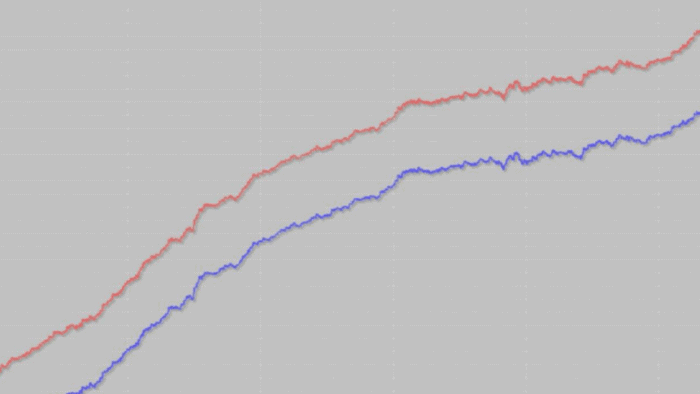

Fortunately, it is the overall annual performance that matters. And when it comes to this, our hedge fund trading strategies have been performing pretty well so far this year.

In fact, we had only ONE strategy loser, and I’m going to share it with you in a moment.

But before that, let me remind you:

In trading, you will NEVER have 100% of trading strategies successful. NEVER. Perhaps for a short period of time, but sooner or later, some strategies will prove themselves to be just losing crap. No matter how hard you worked on it and how much robustness testing procedures you put into it.

In general, from my observation and experience, an algo trading newbie, with the usual newbie naive approach, easily experiences 80-100% of his trading strategies failing within a few months to one year.

This, of course, improves significantly with time and experience.

Right now, with the framework we’re using in my hedge fund (the same I share in the Breakout Strategies Framework), our failure rate is getting extremely low.

In fact, this year, out of almost 30 strategies, we only had to switch one off.

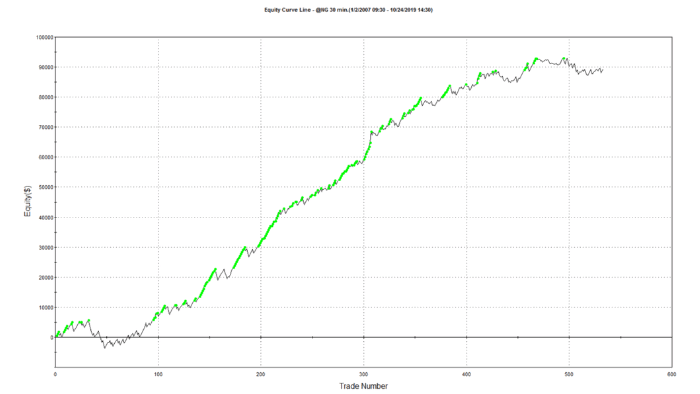

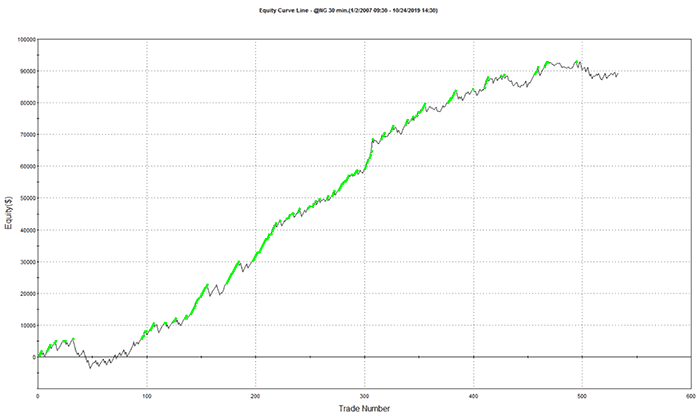

And it was this Natural Gas strategy:

That is, so far, our only ‘strategy loser of the year’. And even this one doesn’t look that bad. It just went too far below our expectations and certain metrics we watch.

So, even after a challenging October, I’m still very pleased. The proprietary robustness framework we use in my hedge fund keeps proving itself year by year as robust and viable, and I’m absolutely comfortable with switching 1 or 2 strategies per year off and replace them with newer and more powerful ones.

And quite frankly, I suggest you do the same:

Be completely fine with the fact that some of your trading strategies will ‘die’ during the year.

Happy trading,

Tomas

P.S.

Also remember: In today’s challenging markets, it’s absolutely crucial to have a constant flow of new, good strategies. If you haven’t done so yet, I definitely recommend watching this free online workshop on how to create a good base of powerful trading strategies using the ‘Combination Screening’ approach.

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.