Shiva is a guy like you.

He loves trading. He’s success driven. He’s smart. And he’s very passionate about what he does.

And he has definitely been one of the most progressive students of the Breakout Strategies Masterclass.

He enrolled in the masterclass just 6 months ago, but since then he has already developed and started trading his first breakout portfolio LIVE.

Let me repeat that:

With the help of the Breakout Masterclass, he has launched his very first breakout portfolio in just 6 months.

Something, you can easily do in 2019 too.

Imagine how much further ahead you can be just 6 months from now. Trading your breakout portfolio live and enjoying what you really like doing. Like Shiva.

And to discover more about Shiva’s story, we’ve recorded an amazing, highly inspiring podcast episode with him.

In this episode, you’ll discover:

- Why Shiva decided to become a trader and the intriguing reason why trading is to him a better profession than anything else,

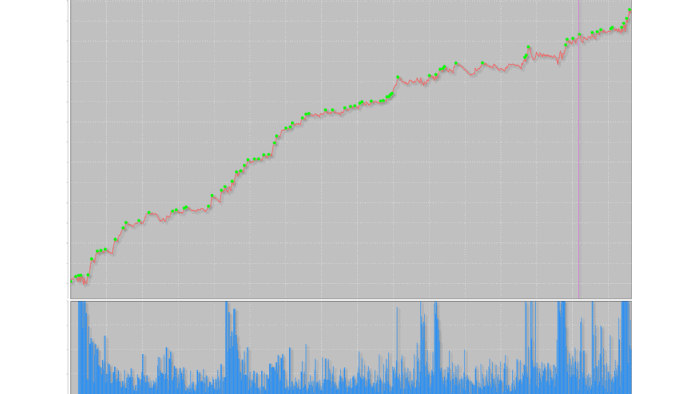

- How Shiva extensively tested the Breakout Strategies Masterclass framework first – to know his money was well invested and that the framework actually works (and his conclusion from the testing),

- What were his next steps after gaining full confidence in the Breakout Strategies Masterclass and what markets, timeframes and personal nuances he decided to use to build his first portfolio,

- How many strategies he has built with the Masterclass so far and how many he launched his first portfolio with,

- His first results with live trading,

- And much more.

So, what’s stopping you from experiencing a great story like Shiva too?

The Breakout Strategies Masterclass has just opened for 2019 enrollment.

So other passionate and driven traders like you can experience a new, breakthrough trading journey in 2019.

You can join us (and Shiva) until this Friday.

Happy 2019!

“I think that the Breakout Masterclass and Dynamic Position Sizing courses themselves are very rich in content. So, there’s a lot that you end up getting.” - Shiva Click To Tweet “With the Dynamic Position Sizing approach, I’m finding you can improve your average trade per contract, but at the same time, your number of trades has not gone down.” - Shiva Click To Tweet

Do you have any trading questions you’d like answered? Submit them here, and we may cover them in a future episode!

![[VIDEO] Can I make money every month in trading?](https://bettertraderacademy.com/wp-content/uploads/2019/03/21mar19-min.png)

![[VIDEO] Don’t use trading techniques as crutches](https://bettertraderacademy.com/wp-content/uploads/2019/06/10jun19-min.png)