A few weeks ago I did a podcast interview with Linda Raschke over on the Better System Trader website.

And in that interview, I made a statement to Linda about her new book ‘Trading Sardines’ and how she seemed to be slightly unlucky to be on the wrong side of so many market outliers over her trading career.

Her response startled me a little, by saying that things that appear unlikely are much more probable than we really think.

For days following that discussion, this statement played over and over in my head.

I thought about it a lot.

And I thought about the implications to traders.

Based on Linda’s recommendation, I started reading the book ‘The Improbability Principle – Why coincidences, miracles and rare events happen all the time’ by David Hand.

The book really opened my eyes.

I discovered that my thinking and attitude towards things that I thought were improbable was incorrect, and I want to share some insights from the book with you today.

The premise of the book is that extremely improbable events are quite commonplace. The author shares several Laws which explain why this is the case, and these Laws can have a profound effect on trading.

One of these laws is the Law of the Probability Lever, which states that even slight changes in the probability of a single event can have a big impact on other rare events.

One of the examples provided in the book is the stock market crash of 1987.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

According to standard risk models, the probability of such a significant drop in the markets was virtually non-existent, even if the stock market was open for billions of years.

However, it DID happen (and there have been plenty of other improbable events occur throughout history).

Why?

Because mathematical models can only approximate real conditions, so even slight deviations from the model can result in dramatic, unexpected events.

This law obviously has direct implications to traders, whether it’s just looking at our trading models, or looking at risk management, or even what we think is happening in the market.

But this isn’t the only factor that can affect traders. The book goes on to reveal a number of other Laws, plus it details some of the many biases humans have, some we may not even be aware of.

So how can we use this knowledge as traders?

Here are the 3 main points we need to accept:

| 1. | Things that we think are unlikely more probable than we realize, |

| 2. | Small changes can have a big impact, |

| 3. | Highly improbable events ARE going to happen to us at some stage. |

Approach trading with a defensive mindset. Be prepared.

It’s a cliché statement but we really do need to ‘Expect the unexpected’.

Only then do we have a chance of experiencing long-term success in the markets.

Andrew

PS. Market Internals is a great way to protect strategies, see it in action for free at TradingMarketInternals.com

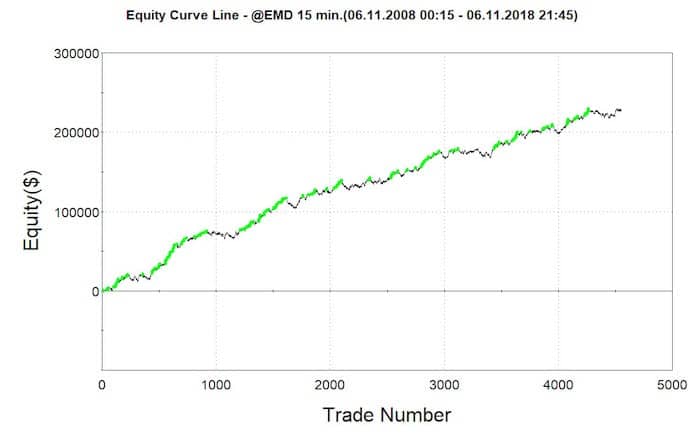

Sick of long and painful drawdowns?

✓ 5-step framework you can use right away to improve your trading performance

✓ 5-step framework you can use right away to improve your trading performance

✓ A proven solution to slash drawdowns by up to 50%

✓ Applicable for index futures, stocks, and ETFs

✓ Quick and easy to implement ✓ You get the strategy code, so you can do it yourself!