If you haven’t seen it, it’s one of those sports movies that every trader should watch.

The story covers the Oakland Athletics baseball team’s 2002 season – when they managed a record breaking 20 game winning streak.

Their winning season changed the way baseball teams select their players – by using data.

The main premise of the movie is that decisions based on data analysis are much more effective than decisions based on instinct or ‘gut feel’.

Despite having a very small budget, the team managed to recruit a winning team because they used stats to pick players.

The Oakland Athletics team were able to build an edge by calculating what really led to wins, rather than relying on what everyone thought led to wins.

There’s often a gap between reality and the way we perceive things.

This is just as true in trading as it is in sports.

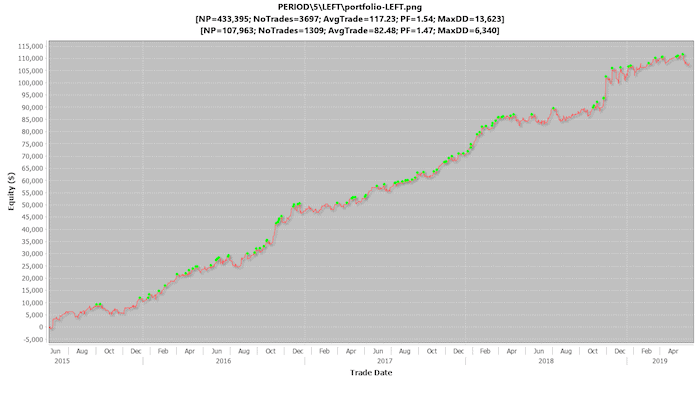

A profitable trading strategy needs an edge. There are lots of ways to build an edge, and each method can help you improve returns and minimize drawdowns.

A topic that a lot of traders overlook is SLIPPAGE – particularly when it comes to testing a system – or deciding whether it will really be profitable when traded live.

Often the best we can do is guess the appropriate amount of slippage to build into a system.

The problem with guessing is that you will probably be underestimating or overestimating.

Underestimating can lead to disappointing real-world results. And overestimating can result in you discarding a system that could actually be profitable.

The good news is that you can stop guessing!

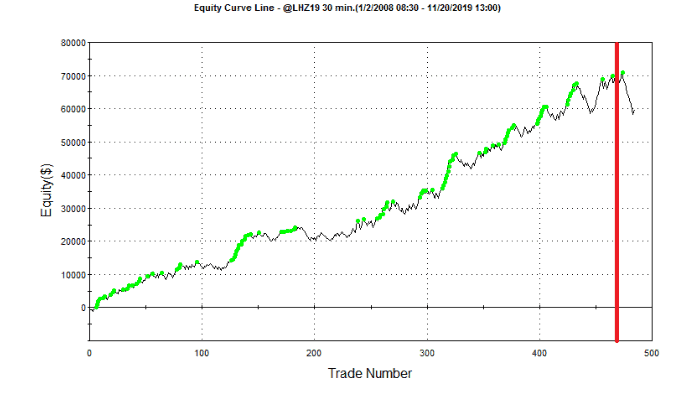

We crunched the numbers on 1000s of trades we’ve executed for our hedge fund to find out how much we were losing to slippage.

In the latest issue of “The Empowered Trader Club”, I’m sharing our key findings from this project.

You will learn how you can close that gap between perception and reality when it comes to slippage. And I’ll show you how you can use these findings to build your edge.

Some of the insights I share include:

- The markets where slippage is really a problem.

- The markets with surprisingly low slippage.

- How we measure and track slippage.

- The best time to trade to minimize slippage.

- How you can use positive slippage to your advantage.

- How slippage varies over time.

- How trade size affects slippage.

If you’re already a member of the Empowered Trader club, look out for your copy of this issue early next month.

If you’re not an Empowered Trader member yet (or don’t even know what it’s about), you can find more details here.

Happy trading,

Tomas