This is funny.

A lot of traders ask me: “How do I know for sure that a strategy is really failing?”

Well, this is, of course, a legitimate question and yes, there are reliable and powerful techniques for that, which I share in the Breakout Strategies Masterclass.

But what really gets me is this…

Nobody asks me this much more important question:

“What gives you the confidence this strategy will work?”

Think of it for a second…

We want to know the solution to the situation when we already ARE in trouble.

As if we’re already foreshadowing that this will happen. It’s as if we’re putting all that hard work into developing trading strategies just to see them fail. And then we start asking “How do I know for sure the strategy is failing?”

But I get it. We have these thoughts because we don’t have undeniable, bulletproof confidence in the strategies we develop and trade. Otherwise, we wouldn’t be so preoccupied with their failure even before we start trading them!

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

And that’s probably what sets me apart from many other traders.

I DO have that confidence.

But, it wasn’t always there. The more time I spent working on my bulletproof robustness testing procedures, the more bulletproof my confidence also became.

Until I had nothing but absolute confidence in my strategies.

Now, if you want to know more about my validation and robustness testing processes, I have 3 different Robustness Levels, and they go like this:

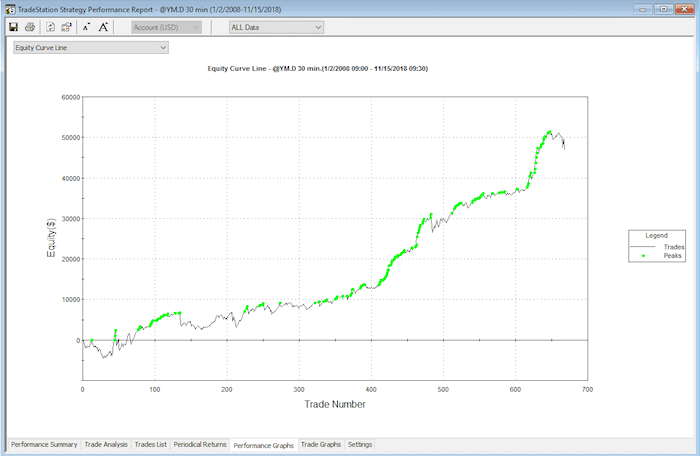

- Robustness Level 1 (RL1) – is not that difficult to pass and strategies at this level are doing relatively well. I usually keep these for monitoring and learning purposes only, not for live trading. Most strategies built by traders would probably sit here (if they’re even that good!).

- Robustness Level 2 (RL2) – is much more difficult to achieve. Any trading strategy that passes this level is a good strategy and I have full confidence to trade it live. About 95% of trading strategies never pass this level.

- Robustness Level 3 (RL3) – this is the “holy grail” of robustness testing. 99% of trading strategies never pass this level. The strategies which do pass RL3 are the ones I choose for my Hedge Fund portfolios. My confidence in these strategies is ABSOLUTE.

In fact, we have several hundred RL3 strategies in our hedge fund database, and after 2 years of true out of sample performance, 93% of them are STILL making money.

That’s only a 7% failure rate, which is one of the lowest (if not the lowest) I’ve seen in the industry.

So, it’s all about confidence.

And you too can have that undeniable confidence… In the Breakout Strategies Masterclass, I explain the exact, step-by-step process behind each Robustness Level (RL1 to RL3).

You can find more details here.

Happy trading!

Tomas & Andrew

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] How to improve trading entries](https://bettertraderacademy.com/wp-content/uploads/2019/02/22feb-video-min.png)

![[VIDEO] Trade with this higher perspective](https://bettertraderacademy.com/wp-content/uploads/2019/05/13may19-min.png)