You want to create a secondary, or even primary trading income. As stable as possible.

And because you’re probably a very smart guy (because most algo traders are), you’ve already done a bit of research here or there and you already know that to create a steady trading income, you need a PORTFOLIO of well-diversified strategies.

But the real question is…. HOW MANY?

Well, the answer has two parts to it.

The first is really a very easy one. Based on my 10+ years of experience in algo trading, the general guidance is something like this:

| 1. | To start, you need at least 3-5 strategies to create a minimum viable portfolio. It’s the very minimum, but it’s a good start. |

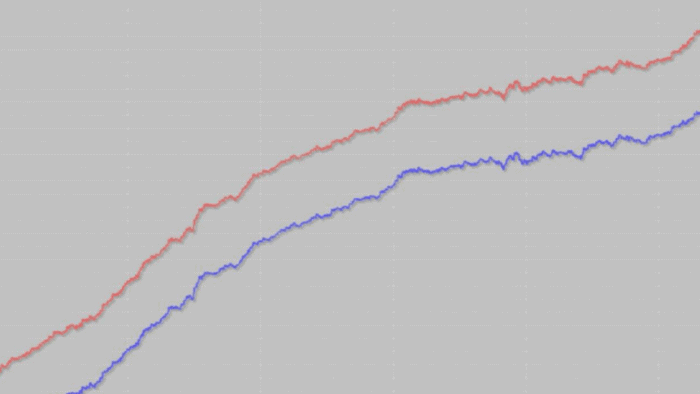

| 2. | If you can afford to trade at least 8-12 trading strategies, you’re in a VERY good position already and should generally be fine. |

| 3. | Anything over 12 is OUTSTANDING diversification and the sky’s the limit (I would say anything up to 25-30). |

Well, that was the easy part.

But as always, there is more to it.

The thing is, to create a small portfolio of 3-5 strategies diversified across different markets, you will need AT LEAST 10 strategies for each market. The key points are:

- You need a portfolio with as low correlation number as possible. Therefore, you will need MORE strategies from each market to have a good selection to sample different portfolios and to get a really good correlation number.

- You only want to trade superior strategies so you’ll need to create more of them to compare and find the best of the best.

- You certainly will want to maximize your profit while minimizing your drawdown and that again can only be achieved if you have more strategies immediately accessible, to sample more portfolios and pick the one that suits your overall goals.

- You will need an immediate contingency strategy at your disposal – just in case.

That means, to create a GOOD portfolio of 3-5 strategies you will EASILY need 30-50 strategies to really build your “best”.

And even then, you might realize that some of the strategies are too similar. You definitely want to diversify across trading logic as well. So, you might even need 100 strategies to create a good, small income portfolio.

Now, I know this sounds like a lot of work. But think of it this way:

Most traders fail.

And from my experience, most traders are just looking for shortcuts and the easy way to get rich quick. But trading success needs honest craftsmanship. You need to do the work, put the effort in, if you want to succeed. So, instead of looking for immediate excuses why this “should not apply to me”, it’s best to be more reasonable and face the reality that it requires hard work to create a really good portfolio. This acceptance will be one of your EDGES against all the lazy traders too. This will give you an additional advantage.

So, think about this, and just get it done.

Good luck and happy trading!

Tomas.

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.