Index Markets are the most popular markets to trade.

In fact, Indexes are so popular they’re often used as a benchmark for performance.

A lot of traders and investors compare their own performance to the S&P500. Produce returns above the benchmark and the investment industry will think you’re superman, but the surprising truth for many is it’s actually quite easy to produce returns that beat the S&P 500 index.

In fact, you can do it in 5 minutes using 4 simple index tendencies.!

Want to know how? In this article I’m going to show you!

The Benchmark

Before I show you how to beat the S&P 500 index, first we need to know what we’re aiming for. After all, we can’t beat the benchmark without knowing what it is!

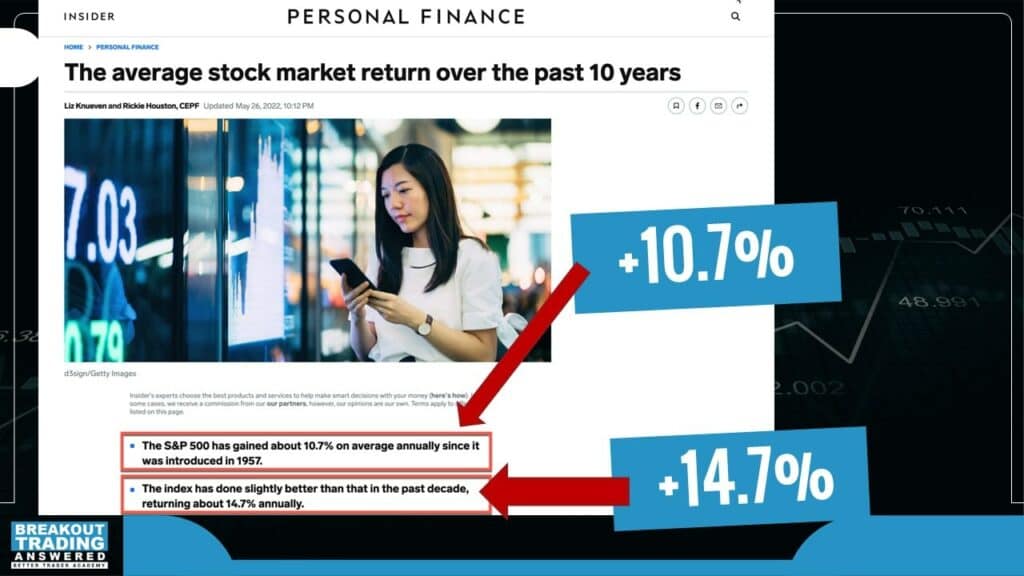

Here’s an article that shows the S&P 500 gained about 10.7% annually since 1957, and 14.7% annually over the past decade:

I think it’s safe to say that the expectation may be about 12%, but the question we need to consider is “what is the cost of that return”?

This year, and many past years, the index has seen large drawdowns. This year we’re down around -25% so far. Other years have had much steeper drawdowns.

We can really create a strategy to compete with that, and the reason we can do it pretty fast and easily is because of something I totally love about indexes – “Tendencies”.

I think this is the biggest advantage of indexes, and that is a lot of indexes or the indexes as a whole group have strong “tendencies”. These principles can be really powerful, so all we need to do is identify them and deploy them, which is what I’m going to show you now.

4 simple Index tendencies that work

Now, I’m going to show you 4 simple tendencies which go back in history, and you’ll see them work time and time again.

I believe these tendencies are so crucial to index trading, that if you deploy just these 4 simple tendencies, you can beat the benchmark. They’re that important!

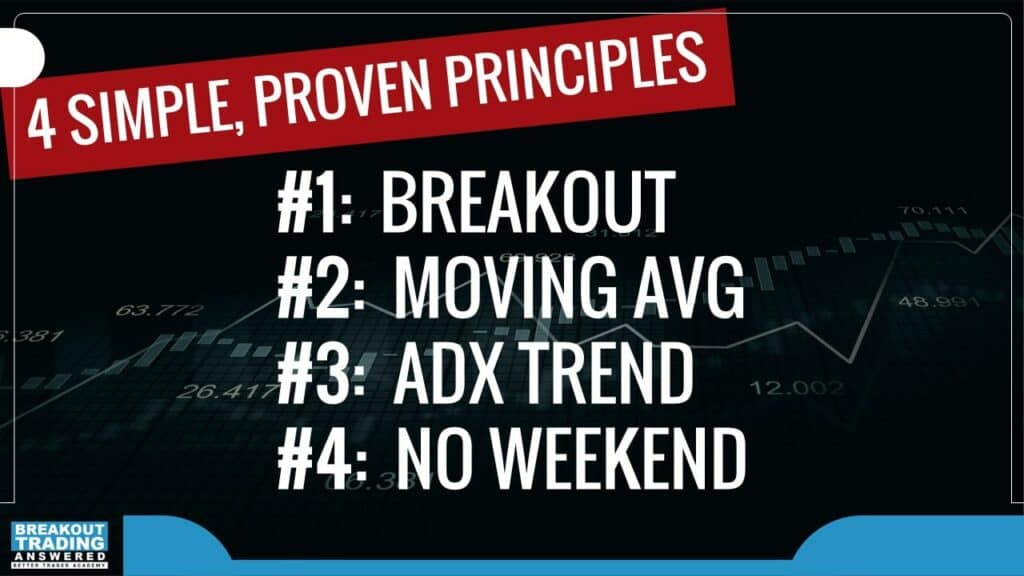

The 4 simple tendencies are:

Let’s talk about these tendencies a bit more, starting with Moving Average.

Breakouts

The first principle is that indexes are fantastic for breakout trading.

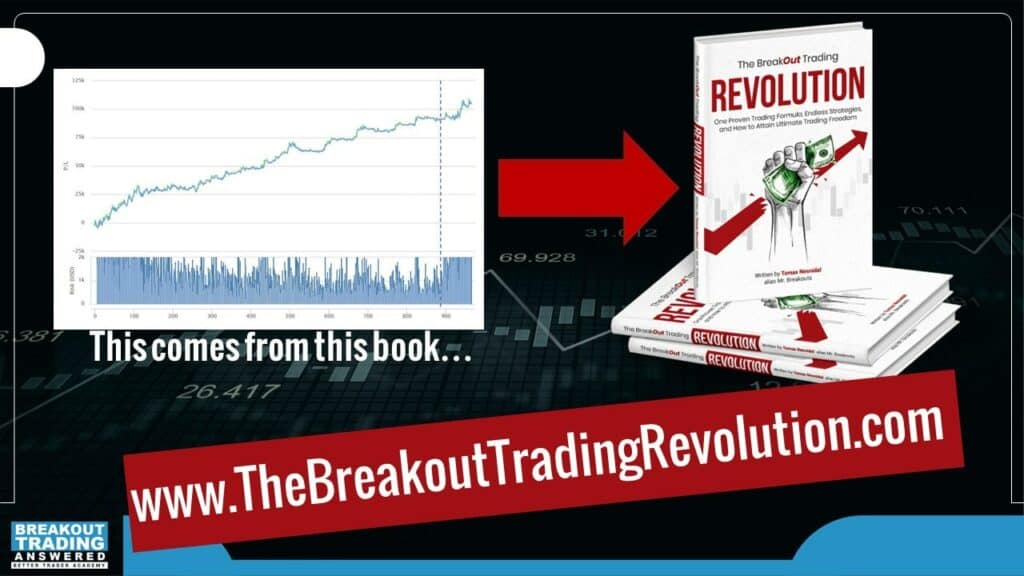

Indexes were the very first markets I deployed the MR Breakouts formula on (which you can find in The Breakout Trading Revolution book).

The Mr. Breakouts Formula works like magic on indexes – Indexes are super responsive to breakouts.

Moving Average

The entire industry, especially the banking industry and the so-called benchmarking industry or analyst industry, use two or three moving averages to determine whether there is a Bear trend or a Bull trend.

The key moving average they use is the 200-day moving average, and from lots of my own testing, I’ve found this moving average is pretty much to this on the spot. It’s very much valid.

I think the whole idea of this 200-bar moving average got so embedded into index trading culture that it created a bias by itself.

ADX

ADX (Average Directional Index) is a trend indicator which helps to identify when we have a strong trend or a weak trend.

I did a lot of research on the ADX on indexes, and it works like magic. It’s very reliable on daily index data, regardless of which index market you want to trade.

No Weekend

This is something I’ll go into more detail in another article, but basically if you only buy on Monday and exit on Friday, that alone creates another tendency.

Combining Tendencies to Beat the Market

In summary, we have four very, very strong tendencies:

- We know breakout trading works.

- We know there’s a built-in bias with the 200 moving average.

- We know ADX works like magic and it’s universal for index trading.

- And we know that exit at the end of the week is also extremely powerful.

So, all we need to do to beat the index is combine them. If you want to see how I do that in code and the results, make sure you watch the replay of the “How To Beat The S&P 500 Index” here:

Summary

The beauty of index trading is that index markets have built in tendencies, which you cannot find so easily in other markets.

And all you need to do is combine the tendencies, using Breakout Trading, the 200 Moving Average, ADX, and exit at the end of the week.

If you use this knowledge of tendencies, this knowledge alone should already give you more than enough to build long term profitable, robust strategies on index markets.

Discover more Index Trading tips

If you want to discover how to master more index trading principles and squeeze tens of 1000s of $ from the markets, check out https://go-bta.com/indexes

November is Index Mastery month, with lots of data, charts, and alot of interesting mind-blowing stuff that will help you tremendously to improve your index breakout strategies.

Make sure you subscribe to the BTA youtube channel so you don’t miss it.

Watch the replay

Want to know how to beat the S&P 500 index with a simple 5 minute trading strategy?

Algorithmic breakout trading specialists Tomas Nesnidal and Andrew Swanscott discuss “How To Beat The S&P 500 Index”, including:

- Why index trading is such a popular option for traders,

- Average stock market returns and why it can be so easy to beat the index,

- 4 simple principles to trade index markets,

- Does the 200 day moving average actually work,

- Using the ADX trend indicator for index trading,

- Slippage, exiting trades end of the week, robustness, index tendencies fading,

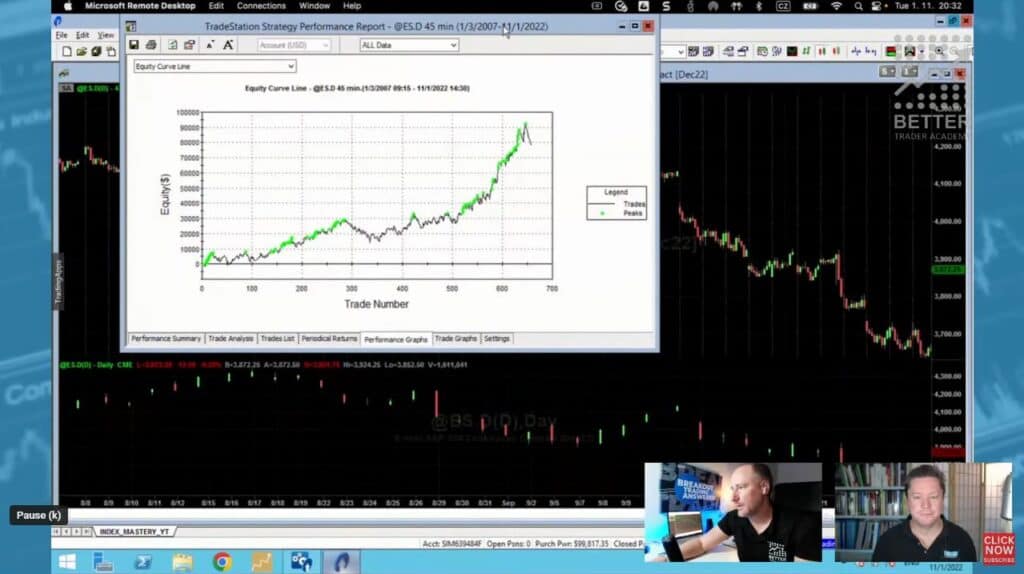

- PLUS we even test a basic index trading strategy in Tradestation to prove index tendencies work!

Episode Highlights:

[00:00] Why trade indexes

[02:20] Average stock market returns

[04:00 Why it can be so easy to beat the index

[05:20] Index trading return last 3 years

[10:20] 4 simple principles to trade index markets

[11:55] Does the 200 day moving average work?

[13:11] Breakout trading in indexes

[14:05] Does the ADX trend indicator work?

[14:51] Exiting trades at the end of the week

[15:39] Index tendencies fading over time

[20:35] Testing a basic index trading strategy in Tradestation

[38:00] Trading long and short indexes in a bear market

[39:10] Testing robustness of index tendencies

[42:00] Other index tendencies to investigate

[44:30] Slippage in index markets

[47:40] The 4 simple steps to beat the S&P 500 index

[49:06] Why do indexes have different long short characteristics

Released: November 1, 2022