But sometimes, even vacations can su*k a bit.

Because it can get boring fast!

I’m currently on vacation in Portugal, in an area called Algarve. I know this area really well because I used to live here, so it’s not as exciting as visiting a new place.

But at least my wife and I are visiting some old locations we used to love when we were living here. And these places are still cool. They still have their old vibe. They still have their magic.

So, as you can see, I’m in a nostalgic mood today.

And this nostalgy reminds me also of something for traders…

An important interview.

Which I did with my friend and long-term broker Martin Lembak some time ago. (Martin’s also the author of the System Trading Unleashed program).

But it is still truly timeless.

It still has so much important information. It’s still worth reading again.

As I said – totally timeless!

So, let’s dive in.

Martin, you have been for many years a part of a team of a brokerage company called Striker.com. This broker focuses mainly on ATS (Automated Trading Strategies) trading. You are regularly analyzing trading systems and their performance. But you are also preparing portfolios created from those systems for clients. Therefore, you have a lot of experience with portfolios. Right from the beginning, I would be curious to know – what is the best way to diversify in order to gain a stable income? What are the basic rules?

Yes, diversification is highly important.

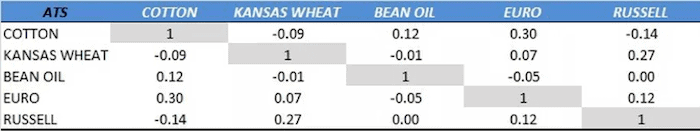

And the key requirement is that a portfolio consists of systems that historically don’t correlate.

Therefore, it is good to have strategies across many different markets and timeframes. And with different logic-defining entries and exits.

Of course, I am talking about a good-quality ATS that functions not only on historical tests but also in out-of-sample ones and in real trading.

It is also important to remember that the correlation between gains can change. It is always good to define different phases of the market. And then examine if there are any periods when performance among different systems can be similar.

And then get ready for such phases (even a well-diversified portfolio will experience drawdowns in the future).

As you know, I personally focus on breakout strategies. From your experience, how many of them should a trader develop in order to create a ‘perfect’ portfolio?

In my opinion, it is mainly important to combine markets from different sectors. Such as indices and then, for example, commodities such as grains, softs, energies, etc.

We can also consider metals such as gold, silver, copper. Although at present such markets can be impacted by macroeconomic factors more than ever before. The movement is also similar to that of indices.

In regards to bond contracts, there is also a large correlation with indices, even though inverse in most of the times.

From my practice, I am pretty skeptical towards intraday trading of forex (FX) based on technical analysis or algorithmic trading. Forex is a largely fundamental market where there are strongly-represented large banks and funds.

There is a relatively good experience with futures on energies such as crude oil and natural gas or gasoline.

As to the optimal size of a portfolio. It seems that 5-7 markets with the application of a given system should provide diversification within one method such as breakout.

From your experience: if the account is growing, is it better to add contracts (position sizing) or systems (as I call it ‘system sizing’)?

In the past, I have spent a lot of time on this topic. And I can say I am an advocate of a classical approach of fixed dollar amount of equity when it comes to position sizing. It means to add another contract only if the original account doubles. And in the situation of a larger drawdown to reduce one. And so on.

Other position sizing methods such as optimal f, full Kelly, and others which are definitely much more aggressive. I am not a fan of them.

And I would suggest ‘system sizing’ – as you call it – as well. It is a good approach to keep diversifying among more markets all the time.

Do you think it is possible to create a quality portfolio for stable income only in one market sector (e.g. indices)? Or is it better to use as many different markets as possible?

It is definitely possible to create a portfolio in one market sector. Anyway, I think for better smoothing of equity (plus keeping or even increasing income potential) it is good to try to also deploy different market sectors. Such other markets should have a price trajectory as different as possible from the “original” one.

What about diversification among different timeframes in the same market – does it also help?

I would rather diversify among different markets with different movements. And use as many different logics of different ATSs as possible.

My Czech students of our Breakout Strategies Masterclass often start with an account between 10,000 and 30,000 USD for which they build their own systems. How many systems/markets would you suggest for accounts of 10, 20, or 30,000 USD? And in general what market would you suggest for ATS with smaller accounts?

Yes, this can be built pretty easily.

As I mentioned earlier, optimally it is good to apply at least 5 systems in 5 different markets.

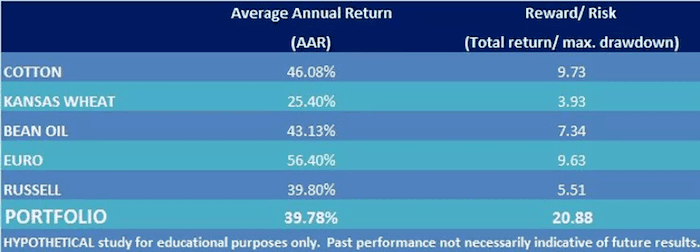

As an example, this is one of the portfolios we trade for one of our clients with a 20k account:

- One swing ATS that trades 1 contract on indices (emini Russell),

- 1 ATS system on Kansas wheat,

- 1 ATS on soybean oil (grains markets),

- 1 ATS on cotton (softs markets),

- and finally 1 ATS on Euro futures (currencies markets).

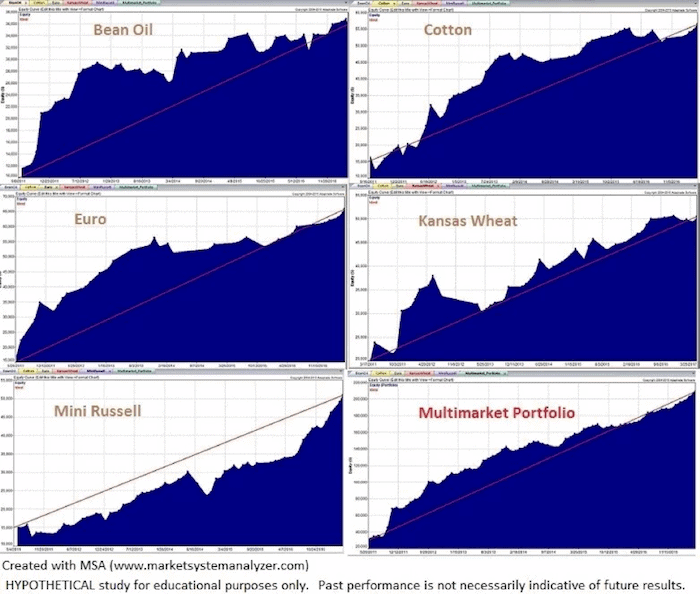

Here you can see an impact of the portfolio (backtests with commissions from the last 6 years – till May 2017). Designed solely for study and past results are not necessarily indicative of future ones:

Notice the Reward to Risk ratio of 20.88, which is a very good number. Hardly achievable with a single strategy (and can get even higher with more low-correlated systems in the portfolio).

Thank you! And the last question. If traders want more trading tips from you, based on your experience with almost 1,000 trading strategies from many different traders, how can they get them?

The easiest way is to download my completely FREE Beginner’s Roadmap.

I hope you’ve enjoyed the interview and now next stop in front of me – one of my favorite cities – Sevilla! :-)

Tomas and Andrew

Finally end the frustration and confusion of getting started in systematic trading

✓ The 6 key steps to fast-track your system trading success today

✓ The secrets of what to do and what NOT to do – saving you time, money and endless frustration

✓ From a veteran broker who has executed and analyzed almost 1000 different trading strategies over his 15 year career – so he knows what works in real trading and what doesn’t!