In the 1990’s, Lemmings was a very popular video game.

The objective of the game was to guide a group of lemmings through obstacles to a safe exit. But, what made the game difficult was that the lemmings would all follow each other in a group. While they were walking around, you had to modify the landscape to guide them, but they would all usually end up walking blindly off a cliff and dying (well they did when I played the game, I wasn’t very good).

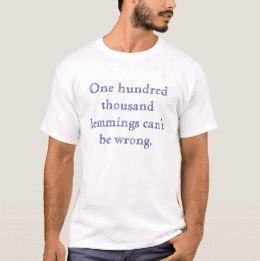

Now, this t-shirt is obviously a joke. It doesn’t matter if there are thousands or even millions of them, they all still follow each other off that cliff.

They’re all wrong in the end.

But what isn’t a joke is this same attitude we see in traders.

Many traders like to keep trying the same old trading techniques. They’re following other traders, and the traders they’re following are using the same techniques other traders are using. It’s just like a group of lemmings, all walking blindly towards the edge of that cliff.

It’s a dangerous way to be and traders often don’t even realize they’re doing it.

So what’s the solution?

Two words…

Be Different.

We’ve all heard the stats about the very high number of traders who fail.

So, if the majority of traders are unsuccessful, wouldn’t it be logical to do something different to them?

Why would doing the same as the failed traders give you a different result?

To get a different result, you need to do something different. It doesn’t have to be something radically different, you can often get good results by taking something that already exists and giving it your own unique twist.

How can you apply this to your own trading?

There are lots of opportunities to be a little different in our trading, so look at what you’re working on now:

How can you give it your own unique twist? How can you use that technique differently? What happens if you use it in the complete opposite way to the traditional approaches?

Test it out – you might be surprised at the results you get.

And if you want to try some techniques that are different to ‘traditional’ approaches, we have a number of programs at BTA that traders are having lots of success with:

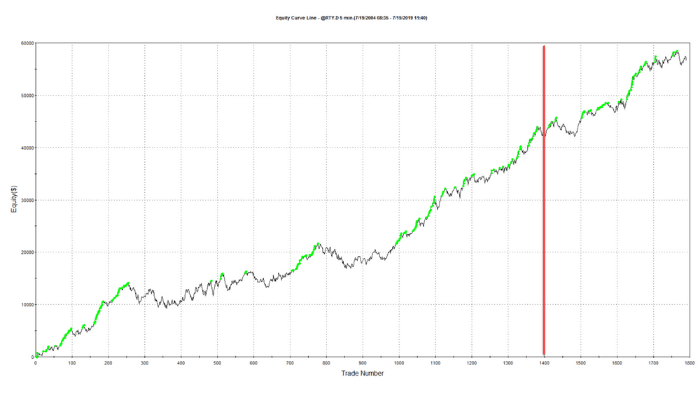

- The 14-day Breakout Strategy Challenge – Build breakout strategies differently. Stop building strategies ‘the old way’. You can do it much faster and easier, even while you’re sleeping,

- Smashing False Breakouts – Look at your entries differently. With these simple techniques, you can avoid more false breakouts and take the genuine breakout signals only,

- Dynamic Position Sizing – Use position sizing differently, and only take trades when the odds are stacked in your favor, including very effective techniques to increasing risk-adjusted returns,

- Trading Market Internals – Assess market conditions differently, and adjust dynamically as the markets mood changes. It’s a great way to reduce drawdowns and take better quality trades.

The techniques in these programs truly are different. They’re techniques that have never been published anywhere else (to our knowledge). And they work.

So don’t be a lemming trader. Lemming traders don’t survive.

Be different.

Happy trading,

Andrew

PS. Yes, lemmings are a real animal too, but they don’t actually commit mass suicide. That’s a myth. You’d also be happy to know that no animals were harmed in the creation of this article.

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.