Last week we have published a post about the optimal stop-loss size. The post obviously brought attention, and I got one very interesting (and important) feedback that I would like to use as a subject for this week’s post.

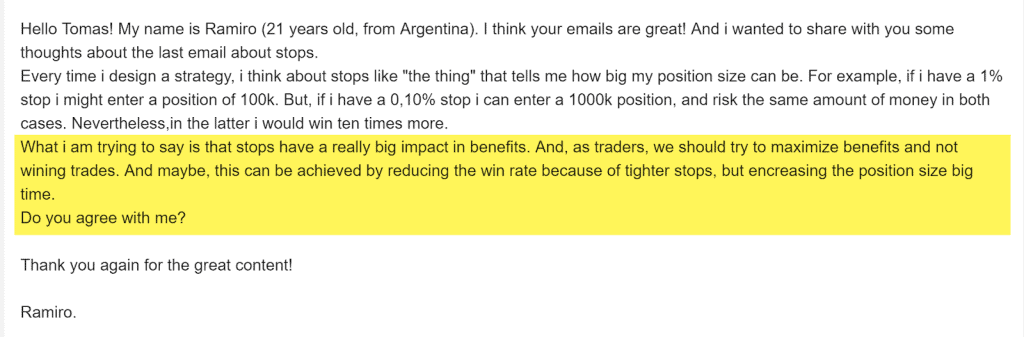

But first, let me post the email and highlight the important part we are going to talk about today:

The first (unhighlighted) part of the email probably talks about variable % stop-loss as a % of your capital (which is a more complex topic and I will probably get back to it in a future email), but the second part is a great comment that can help me bring some basic math and common sense into long-term profitable trading that – I hope – will be beneficial to all of you.

But first, when we talk about prioritizing benefits in front of winning trades, we have to ask this question:

What are the benefits for me?

This can really vary.

For some traders it can be making as much money as possible – no matter what.

For others, it can be having the highest possible stability in the distribution of profits, with a willingness to sacrifice some – or even a lot of – possible financial benefits.

My guess is – for the majority, it will probably be somewhere in between.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

Now, when it comes to Ramiro’s suggestion “and maybe, this (maximizing benefits) can be achieved by reducing the win rate because of tighter stops, but increasing the position size big time”:

If we assume that our main benefit is to make as much money as possible, we still need to understand two absolutely crucial elements before we start adding position-sizing as another layer and seeing if it can help us make more money.

The two mentioned crucial elements come into a simple question:

What is your Risk-Reward-Ratio and what is your %WIN?

Now, let’s do a very simple math here.

Let’s say your Average Loss is 500 USD and your Average Profit is 1500 USD. Your Risk-Reward-Ratio (RRR) is then 1:3.

Now, let’s say that your %WIN (number of winning trades) is 40% (I will explain why this number later on).

So, for each 100 trades, you make (60 * -500) + (40 * 1500) = (-30,000) + (60,000) = +30,000 USD.

Now, an RRR of 1:3 is a really great one. Most often it comes with lower %WIN, which is why I chose 40% WIN in the example.

But let’s assume we do not care about %WIN, as Ramiro suggested, and we put in place tighter stop-losses (to have more positions to trade) – because we have an assumption that this will make us more money.

So, let’s cut the stop-loss by half and have a look.

Your Average Loss will now be 250 USD and the Average Profit will be 750 USD (We are keeping the RRR 1:3 and the WIN 40%).

So, the math would be like this:

For each 100 trades, you make (60 * -250) + (40 * 750) = (-15,000) + (30,000) = +15,000 USD.

So, what really happened here was that with a smaller stop-loss the situation got WORSE (but let’s see later what happens if we add more positions, as Ramiro suggests).

Now, you can argue: “But I thought just lowering the stop-loss but keeping the original average trade +1500 USD”.

Ok, let me tell you this: Then we are already talking about an RRR of 1:6 (250 USD vs 1500 USD) and not 1:3.

And the problem with trading is that – in absolutely most cases (I would almost call it a “law”) – the higher the RRR, the lower the WIN%.

So, with an RRR of 1:6, your win will probably be of 20%. The math goes like this:

(80 * -250) + (20 * 1500) = (-20,000) + (30,000) = +10,000 USD.

So, as you can see – the whole situation keeps getting worse and worse.

Now, let me ask you a question:

How does position sizing help you with this? And can it help at all?

Ok, let’s have a look.

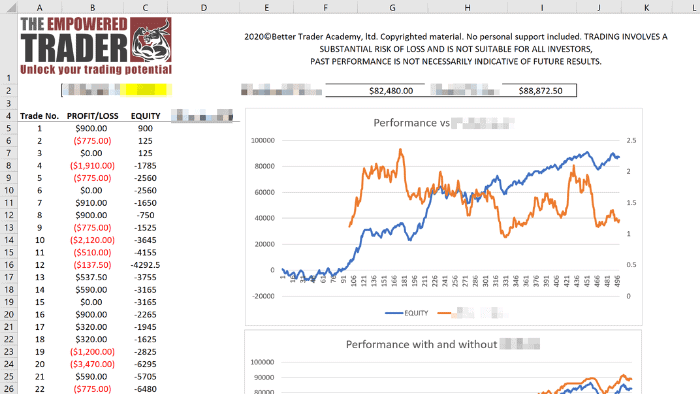

Let’s say you have a 100,000 USD account and you risk 1% per trade.

That means you would risk 1,000 USD for each trade, and in the first case, with the 500 USD stop-loss, you would trade two contracts (1,000 / 500). After 100 trades, you would be up to +60,000 USD (2 * +30,000).

In the second case, your stop-loss would be 250 USD; you would trade 4 contracts and you would be up to +60,000 USD.

In the third case, your stop-loss would be again 250 USD; you would again trade 4 contracts and you would be up to +40,000 USD.

So, let’s get back to Ramiro’s suggestion “and maybe, this (maximizing benefits) can be achieved by reducing the win rate because of tighter stops, but increasing the position size big time”.

As you can see above, the position size doesn’t necessarily make a difference. You make the same money with 2 contracts as you would make with 4 contracts.

What does really make the difference is the combination of the RRR and WIN%.

Finding the sweet spot between these two (which is kind of a psychological preference too) is and has always been a crucial part of my thinking towards long-term trading success.

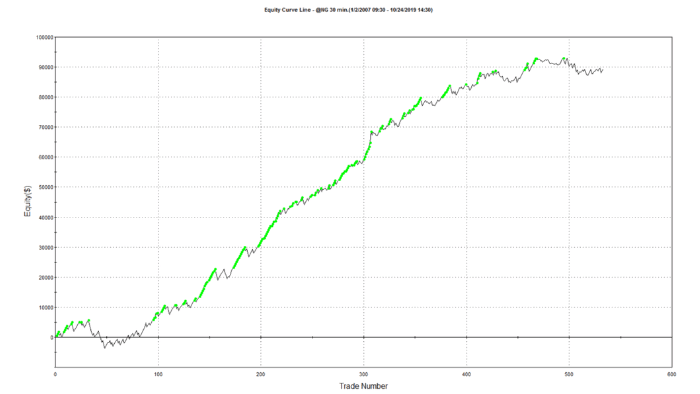

Also, in long-term, I achieve better and more stable results with a portfolio of breakout trading strategies that favor higher RRR (1:2 and higher) and work with a WIN% of 40-60%.

Again, you’ll be able to learn everything important about how I build my breakout trading strategies just in 14 days.

P.S. As I mentioned at the very beginning, I understand the suggestion of variable % risk per trade – as Ramiro suggested in the first part of the email – but this is a bit different topic to which I will get back later.

Andrew and Tomas

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.