Having, and constantly improving small, cozy weekend houses (usually far away from the city).

A calm sanctuary to spend our weekends and relax for the upcoming week.

My parents had a small weekend house about an hours drive from Prague (where I was born) and I used to spend most of my weekends there as a child.

This place always served our family well and I can’t imagine my childhood without the adventurous weekends spent in the big forests or by the ponds full of fish.

During all the years I spent in this beautiful place, I also learned something important:

If you really want good things in your life to last a long time, you have to maintain them well.

I think that all of the cumulated time my parents spent maintaining our small weekend house could amount to years.

Keeping the gardens nice, repairing the house – there is always something to maintain if you want a property to keep serving you well.

And the same applies to trading strategies.

No matter what edge you have in the market, or whatever approach and trading path you’ve taken, your strategy will need occasional changes, updates, and maintenance (even if you trade discretionary).

'No matter what edge you have in the market… your strategy will need occasional changes, updates, and maintenance.' Click To Tweet

We need to maintain. Period.

And the easiest and in my opinion almost mandatory way to maintain a strategy is…

Regular reoptimization!

Markets are changing quickly and often, therefore it’s necessary to make changes regularly.

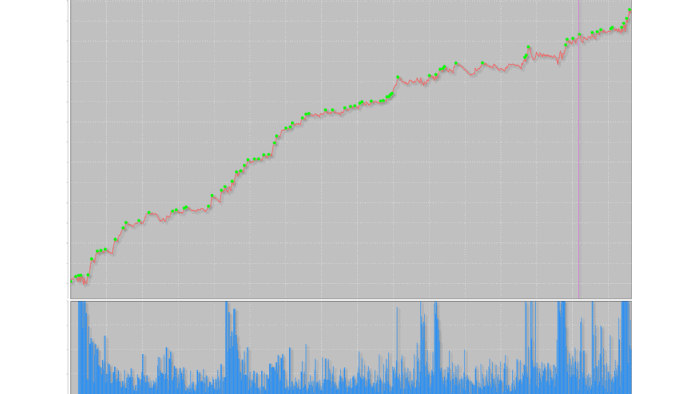

Regular reoptimization is an extremely important part of my workflow and in the past, I’ve learned that…

…regular reoptimization even improves overall performance.

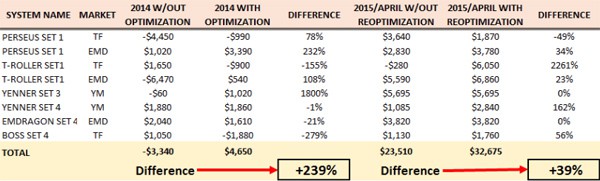

In 2014 and 2015 I traded a few of my trading strategies WITH and WITHOUT regular re-optimization and the difference was pretty staggering:

As you can see below, regular reoptimization in 2014 improved results by up to stunning 239%, and in 2015 by up to +39%:

Since 2015, I now regularly reoptimize all of my trading strategies – because regular maintenance really pays off!

Regular reoptimization solves a lot of challenges, it helps to:

- Adapt to ever-changing volatility,

- Adapt to key fundamental changes in a given market (like new regulations, etc),

- Adapt to different market environments and characteristics as a result of new technology, robots and other factors impacting the markets.

Next week I will share with you two more tips on strategy maintenance that I personally use as well.If you’d like to know more, I explain in detail my own step-by-step reoptimization process in the Breakout Masterclass, including how I reoptimize, how often, what inputs I reoptimize, and what parameter ranges I use during regular reoptimization.

Happy trading and happy maintenance!

Tomas

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] Can I make money every month in trading?](https://bettertraderacademy.com/wp-content/uploads/2019/03/21mar19-min.png)

![[VIDEO] Don’t use trading techniques as crutches](https://bettertraderacademy.com/wp-content/uploads/2019/06/10jun19-min.png)