In trading, we should always expect the unexpected.

But surprisingly, this applies to the positive side of things as well.

When I launched my hedge fund in 2017, I had no idea what to expect. Of course, except for one thing: I definitely didn’t expect a lot of money coming to the fund fast.

But strangely enough, as the unexpected often happens in trading, this is exactly what seems to be happening.

I can call it ‘good luck’, I can call it ‘being at the right place at the right time’, or I can just see it as a natural result of years and years of very hard work. Either way, I was definitely not ready for such fast growth. (Which started happening especially after we decided to pivot from a VIP retail hedge fund to a fund serving institutional clients). And now I feel a bit BEHIND, which is frustrating.

Here’s why.

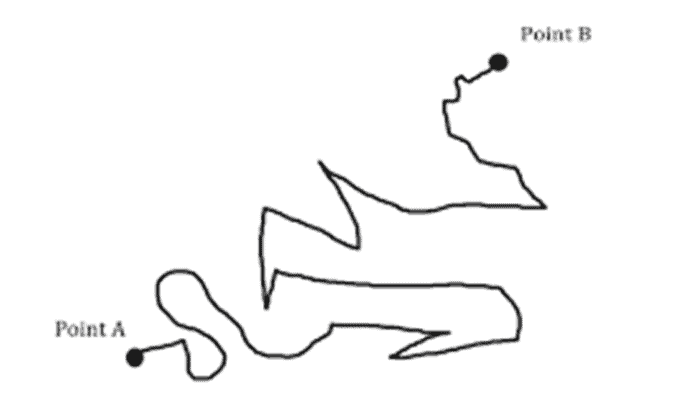

The thing is, I’m a robustness and diversification freak. So, when we pivoted to institutional clientele, we defined our key strategy as something that we call ‘horizontal scaling’. That means, instead of taking a bunch of client’s money and piling them up inside of one or two portfolios, we decided to spread all the incoming investment money across MANY low correlated portfolios. (Of course, each portfolio is also meant to trade with a different trading logic or approaches, risk management settings, and market composition). However, what I really underestimated is – that even with all our team, servers, tech and solutions in place, it still takes time to develop even ONE good portfolio!

Just to give you some idea:

| 1. | ONE portfolio in our hedge fund can consist of 10-20 strategies on average. |

| 2. | But these need to be SUPERIOR strategies, with Robustness Level 3 (a proprietary robustness testing concept I share in the Breakout Strategies Masterclass). |

| 3. | These strategies also need to have different breakout logic and across different markets, to be well-diversified. |

| 4. | Plus, for the sake of good diversification, some of the strategies need to be daytrading and some swing trading strategies. |

| 5. | So, in general, to develop just ONE good portfolio with all these requirements being met, we usually need about 200-300 different, high-quality strategies, to be able to construct a 10-20 strategies portfolio meeting all our requirements. |

And developing 200-300 great new strategies is not fun. Even though we use superior approaches like combination screening and have automated the vast majority of our processes (you’ll get some of my automation tools in the Breakout Strategies Masterclass too), we’re still away from my goal to be able to develop one great portfolio monthly for the next 10-12 months (so we can operate with 10-12 different portfolios in our hedge fund).

Besides that, we’re also developing special algos to manage these portfolios, and that also takes more time than I anticipated. So it’s no wonder that I’m a bit frustrated. The whole month I’ve been pushing my team hard and we’re constantly looking for ways to speed up the development and hire more people too.

But enough of the “complaints”.

Because as always in life, there’s a good part to this as well:

It’s showing us that NOTHING is impossible in trading.

Just imagine. In 2017 I started a journey I had no idea where it will lead to, and today I’m “complaining” about the speed of money pouring into the fund! :-) (Of course, the truth is, that I’m also extremely grateful and excited about all of this).

So, in trading, it’s not all dangerous. Great things can happen too!

In fact, during my entire life, I have never seen such a great opportunity for fast growth that trading offers. Yes, markets are hard. Or, if you will, really tough. It’s a highly competitive environment. It needs a lot of focus and dedication.

But this is also constantly PUSHING you to extraordinary growth.

Personal, intellectual, and financial growth.

This growth often feels like nothing but hard work, a lot of patience and a lot of frustration.

But when you expect it least, big positive things can happen too. And all of a sudden you can be dealing with problems that others wish their entire life they could have the opportunity of dealing with too.

So, always stay positive and never stop working on your trading.

And if you need a hand, or want the support of an incredible community (this community is really special), we’re welcoming you to join us in the Breakout Strategies Masterclass. (Or, if you don’t feel for that yet, start with the free ‘Combination Screening’ workshop).

Happy trading,

Tomas

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.