The company was in extremely poor condition, losing tens of millions of dollars every quarter, trying to sustain a huge amount of products, and with no clear strategy.

Then Steve Jobs took over and he acted fast.

How did he turn Apple around?

He quickly cancelled 70 percent of Apple’s products, laid off more than 3000 people and turned a $1 billion loss in 1997 into a $300 million profit the very next year.

He then started building new products, including the iMac, iPod, iTunes, iPhone and iPad.

This readjusting of products in a company portfolio is quite common, as companies remove poor performing products and services to make way for more profitable opportunities.

A trader, in a sense, conducts a company too, but instead of products and services he uses trading ideas converted into trading strategies. These strategies form a portfolio – just like companies who work with a portfolio of products.

And traders need to do an occasional restructure of their portfolios as well, to remain competitive and improve performance.

'Traders need to do an occasional restructure of their portfolios to remain competitive and improve performance.' Click To Tweet

But portfolio maintenance can be tricky and there are many ways to approach the process of re-balancing and overall maintenance.

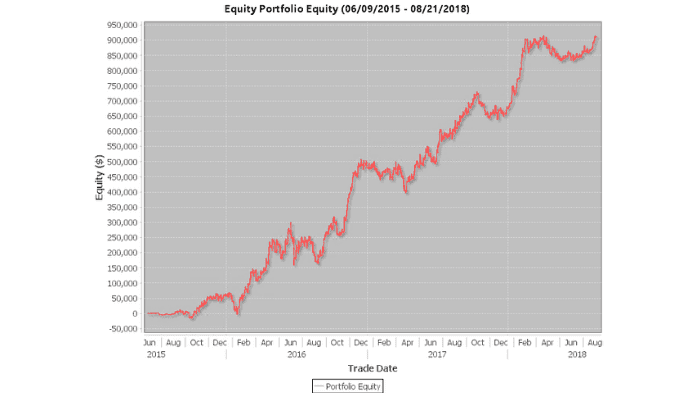

In our hedge fund we spent significant resources researching numerous portfolio techniques, and the way we decided to apply portfolio composition and adjustment is based on the idea of “longevity of breakout strategies”.

We simply created a strategies profile, then based on what we know for how long new strategies usually maintain peak performance, we rebalance the portfolio accordingly.

For our Breakout Masterclass students, I exclusively described the entire process in the coaching call ‘Maximizing the longevity of breakout strategies’ (including the results of our hedge fund research).

If you’re a Breakout Masterclass student, don’t miss the recording of this coaching call, which is accessible to all Masterclass students, including new students that join.

Happy trading!

Tomas

PS. If you’re not a Breakout Masterclass student, you can find out more information about the Masterclass here.

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days