Last week it was one year since I’ve launched my hedge fund.

And it’s been quite a journey, I have to admit.

We had spectacular days, we had bad days.

We faced unexpected challenges in many areas, and we were surprised by the smoothness in others.

So, what have we learned over the first year?

Let me share that with you in this post.

I will try to summarize both the key things that went wrong, as well as the key things that went well.

What went wrong

We had quite a lot of tech issues that cost us money. An unexpected crash of the trading server. Several sudden TradeStation crashes (we still don’t exactly know why they happened). Bugs in our proprietary risk-management platform.

The problem is that trading is an incredibly complex game. And when it comes to tech, everything is far from being perfect.

So, we need to be aware of this and accept it as a part of the game.

Of course, we’re constantly upgrading both our hardware and software. But we also accept that this fight can hardly ever be won, so we need to adjust and keep doing our very best.

We also experienced a few really big overnight gaps in some of our swing strategies. Some made us a lot of money. Some cost us a lot of money. This was probably the most frustrating part of the entire year. Of course, the frustration leads to some ideas too. So, we have started assembling and testing some new approaches, to deal better with this kind of risk. But the results won’t be available sooner than in 5-6 months. In any case, this is a direction that we want to improve during next year.

We also had more losing months than I expected. Stability of the distribution of profits is still a challenge. A big part of it is the fact, that we applied some really experimental position-sizing approaches. These helped us to make a lot of money but also kept us in longer drawdown periods than expected. As a result, we are currently testing and implementing even more advanced versions of some of our proprietary position-sizing algorithms. They should get the portfolio volatility more under control and improve the distribution of profits. Plus we’re planning to get even more diversified too.

We also accepted some clients on equity highs, and that was not a smart decision. For the next year, we’re preparing new client acquisition procedures. These will include accepting new clients in pullbacks and drawdowns mainly.

And finally, we planned to launch 3 CTA programs this year, which is not going to happen. We launched “only” two. We are simply too busy with all the other stuff mentioned above.

What went well

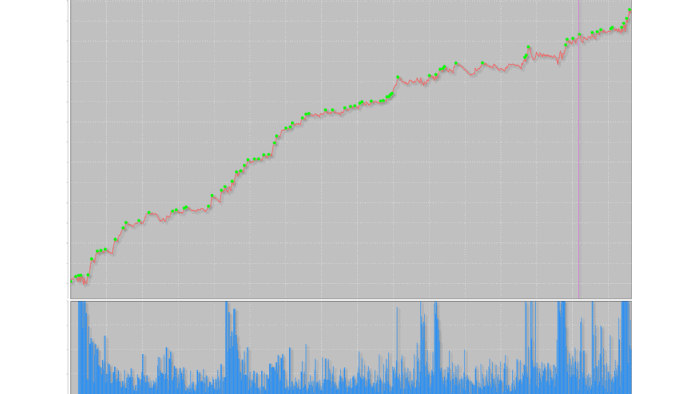

First of all, we have spectacular returns (despite all the hurdles).

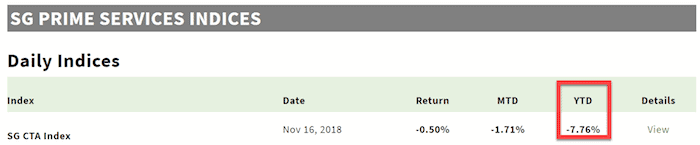

Let’s start by looking at the SG CTA Index.

The SG CTA Index is equal-weighted and reconstituted annually. It has become recognized as the key managed futures performance benchmark. The index calculates the net daily rate of return for a pool of CTAs selected from the largest managers open to new investment.

Source: https://cib.societegenerale.com/en/prime-services-indices

As you can see, the CTA performance average for this year among the industry is currently -7.76% (at the moment I am writing this post, which is the end of November). Our CTA1 program is currently fluctuating between +60 and +65% (the balance changes every day, currently it is +61%). These numbers are BEFORE our performance fee. So, we’re beating the industry average this year in a big way and are among the top performing CTAs. (Note: We are a private hedge fund and do not accept retail clients).

Our CTA2 program has been launched just a few weeks ago and is currently around break-even. Still, too little time to show up some statistically significant results.

Next, none of the 15 strategies that were currently trading, failed. None even got close to the maximum historical drawdown. The vast majority of trading strategies are doing pretty well. (I believe this is due to my exceptional robustness testing framework, which is way beyond industry standards. And which I fully share in the Breakout Strategies Masterclass).

Also, the entire year confirmed that the Dynamic Position Sizing techniques we’re using are an obvious extra edge in our hedge-fund. Yes, it also caused some unexpected volatility in our portfolio, but we’re still balancing the implementation, fine-tuning the optimal set-up and combinations.

And finally – despite all the challenges we survived! :-)

The biggest takeaways for you

First of all, whether you have ambitions to launch your own hedge fund, or just trade your own money – DO IT.

I mean, put together your first portfolio and launch it.

Don’t wait for the “perfect” moment.

Don’t keep postponing by trying to have everything solved and under control in advance.

It will never happen.

The nature of the trading business is to keep surprising you constantly. Both negatively and positively. It is part of the game. If you keep waiting for “perfection”, you’ll never move ahead. You will be stuck forever. When we launched our first CTA program, everything was far from perfection. Yet, we survived, and we’ve learned a lot. We made money, made a lot of improvements, and kept going.

Second, always believe in yourself. Trust yourself. Believe that you can do it – even in the worst possible circumstances. Keep going. Don’t look back. Stay highly persistent to reach your trading goals.

And finally, if you are still looking for a reliable, proven strategy development framework, go for our Breakout Strategies Masterclass. This is the exact same framework we use in our hedge fund. The framework has been very fruitful for me so far. And fortunately, for many students of the masterclass as well.

Happy trading!

Tomas

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] Can I make money every month in trading?](https://bettertraderacademy.com/wp-content/uploads/2019/03/21mar19-min.png)

![[VIDEO] Don’t use trading techniques as crutches](https://bettertraderacademy.com/wp-content/uploads/2019/06/10jun19-min.png)