Sometimes you have a great opportunity to learn things that are hard to believe.

In fact, I’m still a bit astonished by something…

Very soon I’ll be entering the third year of running my hedge-fund. During that time, my business partner and I have had a myriad of meetings with big banks and financial institutions (especially after we decided to pivot to institutional clientele only.)

Now – I used to believe these big banks and huge financial institutions had the best traders in the world. They have all the money to hire them and all the money to give them superior training.

But to my surprise… this is NOT the case.

In fact, it’s much worse than you probably expect.

Quite often, once you start talking about algo-trading to representatives from these institutions, they seem to be completely lost.

For example, at the start of this year, I had some preliminary talks with a major bank in Asia. To my utter surprise, they didn’t even know what algo-trading was. They were completely lost. The only thing they understood was real estate and long-term stock holding. You know, stuck in the 1950s.

Or, during another meeting with a big investment fund in central Europe, we were asked by their allegedly “best trader”, what indicator we use in our strategies. We tried to explain to him that it depends on what our Combination screening process selects and our robustness testing procedures confirm as viable. Then we started talking about genetic algorithms and Monte Carlo analysis. He was completely lost and had no idea what we were talking about.

And to make it even more puzzling, I once talked to a woman from a major European bank, who worked there as the main bond trader. Her department was in charge of multi-billion dollar bond trading. The shocking part – she didn’t know what she was doing. She confessed that to me once, when she came to me for advice on what she should do. She was hired for her superior education and past references, but she had no practical experience in trading. The bank didn’t provide any training either. They only set her goals. The poor woman ended up with a serious mental disorder.

And I could keep going on and on.

To me, the last two years were full of shocking revelations about HOW MUCH THE VAST MAJORITY OF THE FINANCIAL INDUSTRY IS BEHIND.

They are stuck in old paradigms.

They’re paralysed by corporate structure and policies.

They hire people based on theoretical education references, not actual skills.

Their traders are mediocre at best. Stuck in the past (and the buy-and-hope approach). So, here’s my point:

There are very high chances you’re already set up for major success much more than you think.

Especially if you ever thought that the measurement of your readiness is big financial institutions.

What these financial institutions can do masterfully, is to make the impression of how smart and invincible they are. To even intimidate everyone with their image. But that is just a veil. Behind that, you often see people with very little trading skills and knowhow.

Believe me, I was shocked when I realized this. And it’s a good thing.

Because this leaves you with much more readiness to make it in trading than you might think right now.

Ignore the hesitation and fear. Go and do it anyway. The chances are, you’ll be way better than the vast majority of institutional traders the moment you start.

Happy trading,

Tomas

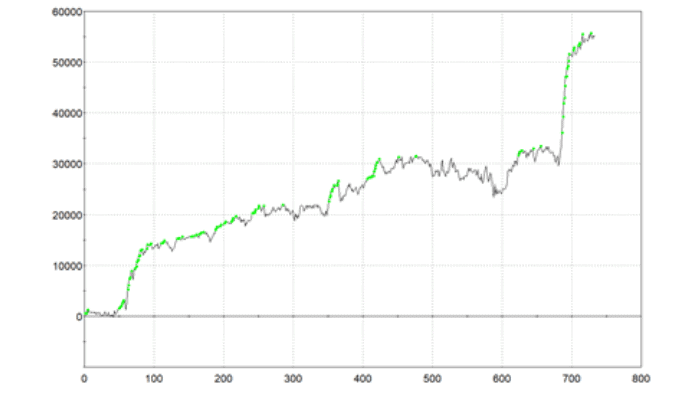

P.S. All these success stories prove a point. People trading for themselves are usually way further ahead than what I’ve seen in some of the big financial institutions over the last few years.

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.

![[VIDEO] How to SURVIVE the coming crisis](https://bettertraderacademy.com/wp-content/uploads/2019/08/12.aug-FI-min.png)