When you have power, you have the ability to always get the very best.

People in power own real estate in the most exclusive areas. They date models and celebrities. They go to lunch with people of incredible influence. And of course, they have the very best people working for them.

They are in power, so they have the ability to choose only the BEST – all the time.

The good news is, ANY trader can have power too.

At least in the area of developing an algo-based money-making machine.

Yes, I’m talking about COMPUTER POWER.

It’s cheaper and more accessible than EVER in history. And this power brings the potential to create a large number of high-quality strategies easily.

Yet, most traders don’t use this power.

They prefer to stay attached to obsolete ideas like “2-3 good strategies are all you need”. Thus, they do not utilize the power they have available, and they miss out on the ability that can catapult them into the world of substantial financial opportunities.

And many traders just don’t get it.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

Let me explain why using this power and producing a GIANT amount of great algo-trading strategies every day is not just an option, it’s a MUST.

First of all, let’s start with the assumption that to produce a good, stable, reliable trading income, you need at least 4-6 low correlated strategies. I can’t agree more.

However…

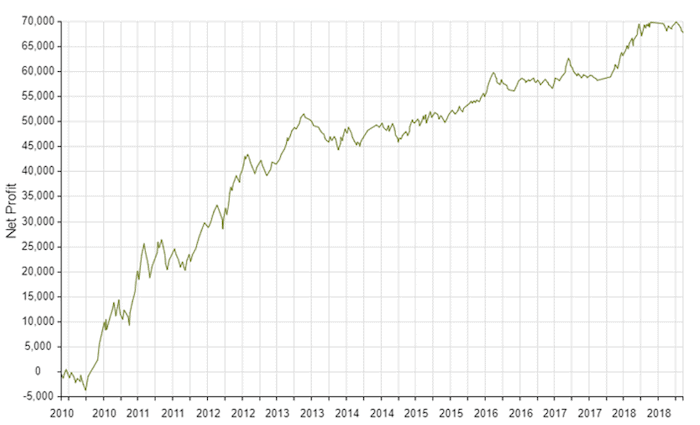

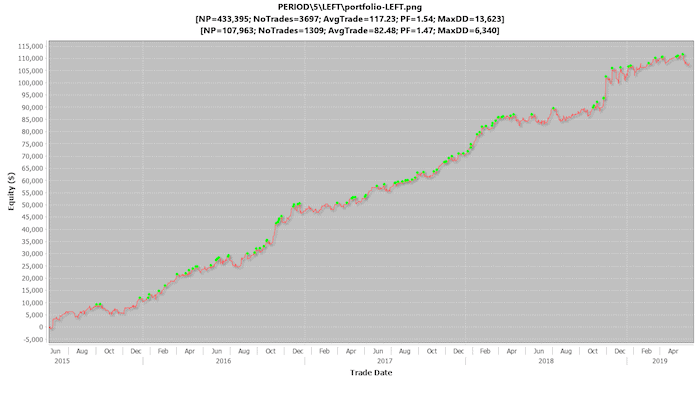

Even when we construct a very small portfolio of 4-6 strategies in our hedge fund, we usually need at least 10-15 times more strategies to construct the portfolio RIGHT.

Yes, 10-15 times more!

That means up to 90 high-quality, robust strategies, to create a REALLY GOOD portfolio of just 4-6 strategies. Here’s why:

Some strategies simply can’t trade together. Because they could start “resetting” each other with contradictory positions.

Also, some strategies don’t offer the sufficiently low correlation numbers we’re aiming for.

And many strategies don’t work as well on other markets as we prefer (although they are VERY robust).

Plus, some strategies use similar logic and components, which we also want to avoid, to be well-diversified.

We have other requirements. For example, we want to combine as many different timeframes as possible. Because true diversification means you’re diversified in EVERY ASPECT POSSIBLE, and we also want to have different trading “speeds” (which are often defined by the timeframe).

And if that wasn’t enough, we need sufficiently high SQN numbers to make sure the strategies in the final portfolio are well prepared for position sizing. (And I’m not even mentioning my strict Risk-Reward-Ratio and other performance stats).

So, to construct a really GOOD small trading portfolio, for a steady, reliable income, you first need LOADS of trading strategies to choose from. And I’m talking about high-quality, robust strategies.

Now, you might think this is not for you. That this is just for the hedge fund.

Then listen to this:

This is a procedure that I established BEFORE the hedge fund and that was constantly helping me to produce BETTER results than many other traders.

All because I was actually using the power I had, constantly aiming for true, even EXTREME diversification.

And also because I just LOVE having the exclusivity of choice. (And I believe so do you).

So, my suggestion is:

Leave the obsolete thinking behind.

Switch to the MODERN mindset and take advantage of all the amazing possibilities we now have as traders.

And if you still don’t know how to start building a lot of good strategies fast…

… start with this FREE online workshop.

Happy trading!

Tomas

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.

![[VIDEO] How to SURVIVE the coming crisis](https://bettertraderacademy.com/wp-content/uploads/2019/08/12.aug-FI-min.png)