Even the conventional wisdom of successful investors, like Ray Dalio.

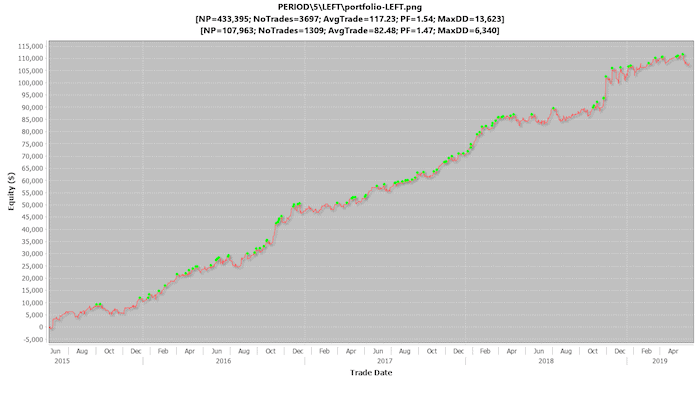

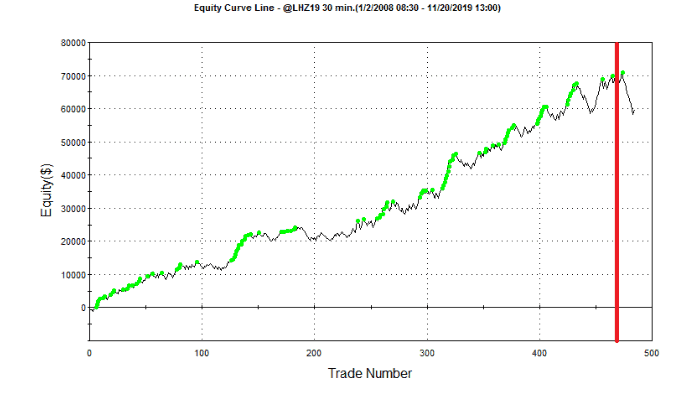

My hedge fund team and I recently put one of Ray Dalio’s insights to the test, and conducted EXHAUSTIVE research on the effects of correlation and diversification on the performance of a portfolio of algorithmic breakout trading systems.

The results were enlightening and by challenging a common principle about diversification, we worked out the key factors that lead to more predictable trading results. (and we also discovered that most traders probably aren’t doing diversification in the best way either).

I’m sharing the key findings from our research in the latest issue of “The Empowered Trader Club.” In this issue you will find out how correlation, diversification, position sizing, and system sizing all affect the predictability and stability of the returns for a portfolio of breakout trading systems.

If you’re not an Empowered Trader Club member yet (or don’t even know what it’s about), you can find more details here.

If you’re already a member of the Empowered Trader Club, you’ll receive the issue in the first week of August.

Happy trading,

Tomas