Yup, that quote was from President Trump.

Now I’m not going to get political here, but I’m always a little skeptical when something is blamed on a “glitch”. Here’s why:

In July 2018, a “computer glitch” caused the cancellation of 3,000 flights, costing American Airlines an estimated $35 million. Oops!

In 2012, the Knight Capital Group lost $440,000,000 due to a “trading glitch”. Ouch!

And what about Trump’s “little glitch in the stock market last month”?

Well the S&P 500 dropped more than 9%, which was its worst December performance since 1931.

And according to Howard Silverblatt from S&P Dow Jones Indices, U.S. stocks lost about $2.9 trillion in value.

So, $2.9 trillion is a “little glitch”? Hmmm.

Usually, when someone blames an event on a “glitch”, they’re trying to downplay it using a “cute” term, but the current global situation is far from cute.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

We’re seeing government shutdowns, trade wars, rising tension between nations with powerful military capabilities, and Santa didn’t even deliver the Santa Clause rally this year. Boo.

The US stock market has just had the worst annual performance in a decade, and some experts are suggesting the US is on the brink of a recession, so with so much uncertainty and fear in the markets, even the smallest thing could be the catalyst for dramatic market moves.

It all sounds rather grim, so what’s a trader going to do?

Well, no one really knows how it’s all going to play out, so the best approach is…

Be prepared. For anything.

How?

Here’s how I’m doing it – with a portfolio of diversified strategies.

A portfolio designed to take advantage of as many different market environments as possible.

Using the framework Tomas shares in the Breakout Masterclass, I assembled a portfolio of diversified strategies across different markets, timeframes, styles (intraday and swing) and different core logic.

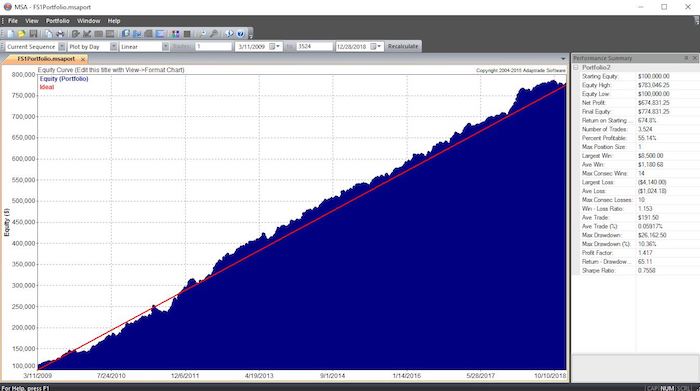

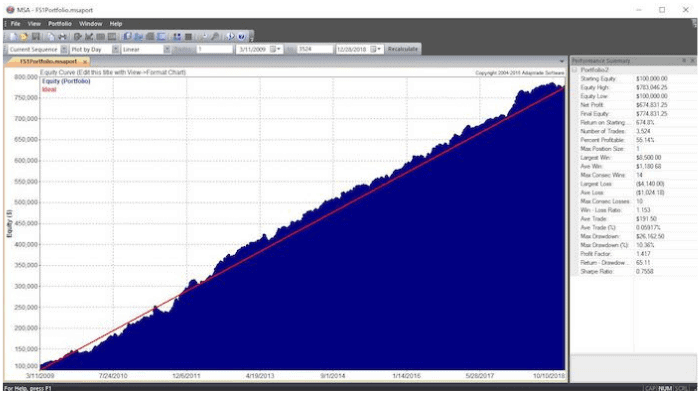

This portfolio (which I’m trading LIVE), consists of a mix of intraday and swing strategies in Emini S&P 500 (ES), Mini Dow Jones (YM), Crude Oil (CL), Soybeans (S), Natural Gas (NG), Bonds (US) and Gold (GC).

And here’s the Out Of Sample (Walk Forward) results of the portfolio, based on 1 contract per position:

Image courtesy of Market System Analyzer

Now there’s obviously no guarantee this portfolio of strategies is going to perform well over the next few months or years, but it’s better than sitting around and hoping a market “glitch” doesn’t wipe out my trading account.

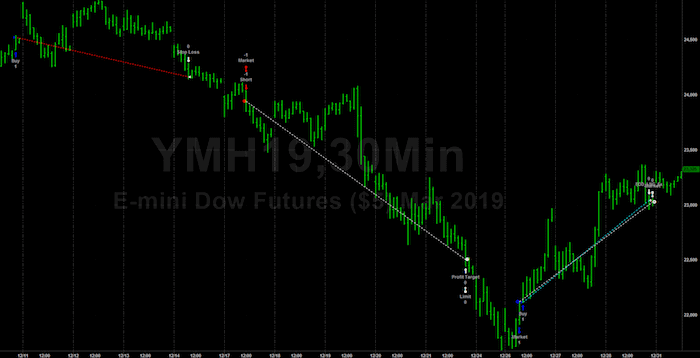

Even just having strategies that can go Long or Short can help, like these actual trades my YM swing strategy took in December, going Short while the market was falling (and the “Long only” traders were hurting) and then going Long again on the bounce.

Anyway, I share this not to brag, but to show that it is achievable, and to encourage you to be better prepared for whatever is coming.

Don’t let a “glitch” in the markets wipe out your trading account.

If you’d like to discover how to build breakout (and swing) strategies for all markets, check out the Breakout Masterclass, it’s open for enrollment right now, but only for a few more days.

Happy trading in 2019,

Andrew

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] Can I make money every month in trading?](https://bettertraderacademy.com/wp-content/uploads/2019/03/21mar19-min.png)

![[VIDEO] Don’t use trading techniques as crutches](https://bettertraderacademy.com/wp-content/uploads/2019/06/10jun19-min.png)