There are many things that can contribute to a trading strategy losing money.

In the “How to stop losing money” series, we analyse (and provide solutions for) a number of different challenges traders have to face.

In this article, we’re going to analyse a fundamental issue traders often neglect. This is something that could mean the difference between being a successful trader or well… not being successful!

It’s the importance of having a winning trading model.

The difference between a trading model and a trading strategy

The terms “trading model” and “trading strategy” often get used to mean the same thing.

However, they’re not. And understanding the differences can have a BIG impact on a trader’s progress and performance through their trading journey.

Sounds dramatic? Let me explain.

I guess it might be good to start with some definitions. What is a model? What is a strategy?

The difference is actually very simple, but it’s quite important and profound as well.

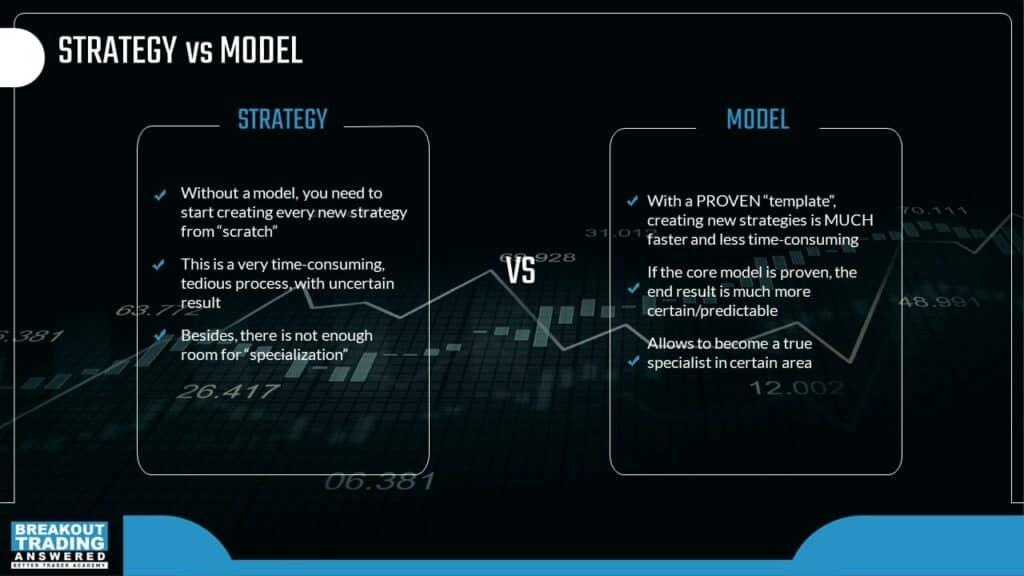

A trading strategy is a set of rules to enter and exit the markets. Every trader knows what a strategy is, and most traders understand the necessity of having entry and exit rules, so this is nothing new.

However, a model is different.

A model is a higher level than a strategy. It’s a framework that specifies the components we need to include in a trading strategy.

It’s a template to create an unlimited number of trading strategies.

Why traders need a trading model before a strategy

Some traders may ask “why isn’t a trading strategy enough?”

“Why can’t I just jump from strategy idea to idea?”

“Why do I need a model or template?”

There are 3 good reasons why every trader needs to have a reliable model before a strategy:

Speed

So first of all, without a model, you need to start creating every new strategy from scratch.

If you don’t have a template, if you don’t have a model, you start at the beginning each time you want to create a strategy.

You have no guidance, so you’re starting without knowing at least partially where you are going.

And this can turn into a very time consuming, very demanding, very tedious process with very uncertain results.

However, with a proven model, creating new strategies is much faster and less time consuming, because you already have this template, you already have this guidance.

You just follow this template, so the efficiency of strategy creation multiplies by a huge factor.

Plus, with a repeatable process, it’s much easier to automate, which can be a huge timesaver!

Results

If the core model is proven, the end result is much more certain and predictable.

If we just move from strategy to strategy and we do not work with a proven conceptual approach, we’re facing a very high level of uncertainty.

Whereas, if we work with a model which is proven, basically any new strategy that we create already has a built-in level of confidence or predictability, because we know we’re working with something that has been proven.

Robustness

Having a proven model can also mitigate the risk of losing money.

If we can see and prove that with one model we can create strategies on multiple timeframes and markets, we already know we’re working with something that has a built-in edge. Something that is robust.

You can think of it like stress-testing a concept.

And that’s why losing money with a proven model is harder than with standalone strategies.

There can be absolutely amazing standalone strategies created, but a singular strategy doesn’t have this proof of robustness across many different markets and timeframes like a model can.

Losing money

So let’s look at how this can apply to losing money.

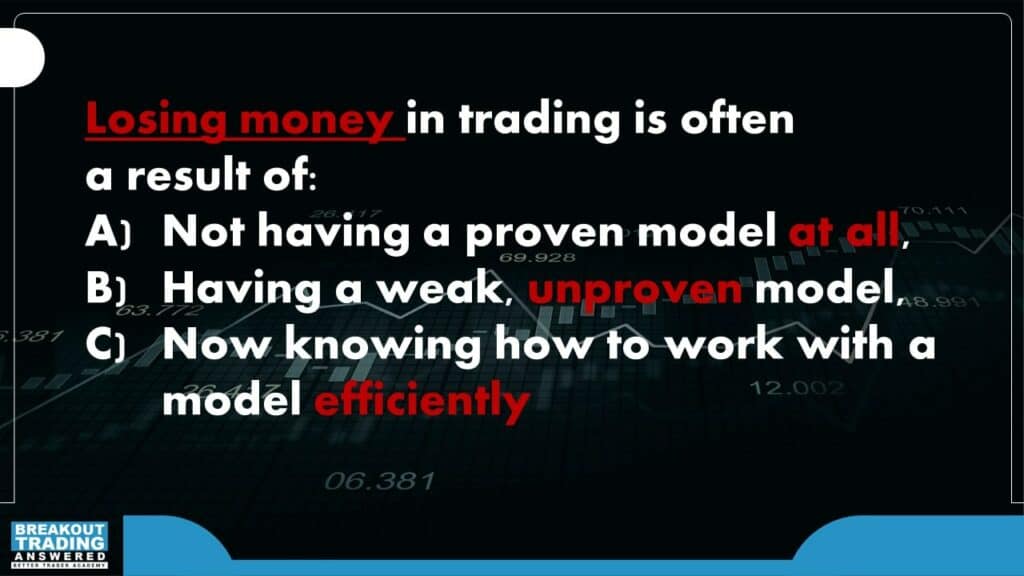

Losing money in trading is often a result of not just having an unproven strategy, but not having a proven model at all.

A good trading model gives this bigger picture conceptual approach. If it’s a weak unproven model, then we cannot expect good results.

Traders often need to take a step back and start thinking in terms of what they’re really doing – are they thinking at the strategy level or the model level.

I’ve met a lot of traders who had an intuitive model because they were intuitively doing the same thing again and again, however they were not able to summarise it and describe it as a framework, so they were not really working efficiently with their approach.

So the absence of a proven model can be quite an important aspect behind losing money now.

The solution

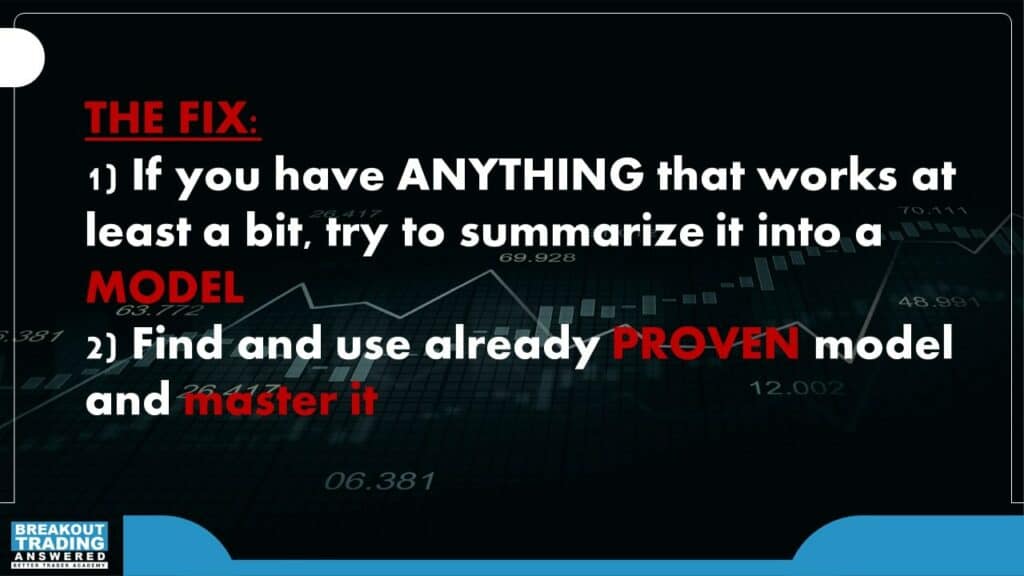

How do we fix this? Actually, it’s not so difficult. You have 2 options:

If you have anything that you already used to build a strategy that works at least a bit, then step back and think if there is a way you can summarise it into a model. Can you create a template around it?

If so, test the model on different markets and timeframes to see if it works in other places as well.

If it does, you could have a good model on your hands, and now you need to master it.

Keep testing the model, tweaking it on different markets and timeframes until you really see the strengths and weaknesses.

And one you master the whole model, this is the real treasure because now you have something you can keep using again and again, potentially your entire trading life.

That’s the real value we hold in our hands with a model, because now we can independently work on different markets and timeframes and it also gives us confidence by having a strong universal base.

How to determine if you have a good trading model

Universal

So what I’m aiming for with a good model is something that is universal – a model that can create strategies on as many different markets and timeframes as possible.

In the past, I tested a lot of different models and one of the models I tested on indexes got very good results. But when I took the same approach to different markets, it completely flopped. With that model, I was not able to develop anything outside of indexes. The whole idea was optimised for indexes only, so iIt was not a good model.

Whereas, when I created my first version of the breakout model, I was able to create breakout strategies on the vast majority of futures markets. I was able to use the same model and get results on grains, metals and even stocks. Then I knew I had something that was universal.

That’s how you know if you have a good model or a bad one.

Simple

Another factor that defines a good model is simplicity.

If you have a complex model, it’s very hard to test across different timeframes and markets. You need to do this quickly because many model ideas will fail. So you don’t want to get stuck with one model for two years and then realise that it’s crap. So yes, simplicity is vital.

Flexible

It’s also important that the model needs to be flexible and adaptable.

A friend of mine had a model based on some ideas from Larry Williams. It worked great at times, but this model was so tied to particular market tendencies that it wasn’t scalable. If you wanted to take this whole idea and put it on a different market, you couldn’t because certain markets like energies, they’re driven by some fundamental news which other markets are not.

It was not scalable.

A good model needs to be flexible. It needs to be able adapt to any market and any market condition as well.

Specialized

And finally, I think there’s something really profound in niching down and specialising in a very, very specific area. Breakout trading is a fantastic area to be a specialist, which is why I’m called Mr Breakouts. This specialisation only happened because of my breakout model, because I went through many models and started to narrow down.

I know traders who are very specialized in specific areas, and usually these traders are highly successful. So I really believe that having a model, which is somehow niche, like breakout trading can be a big, big plus as well. And it’s definitely more efficient than just jumping from one direction to another.

A powerful breakout trading model you can use

We’ve been talking about my breakout model quite a bit, so let’s have a quick look at my simple breakout trading model.

Alot of traders already know my breakout rating model.

It’s super simple.

It’s highly universal.

It’s flexible and adaptable because it’s got adaptive components like space calculation, which is highly adaptive.

If some traders don’t have a model, this is a proven trading formula. You can create endless strategies with it.

The biggest proof the model works

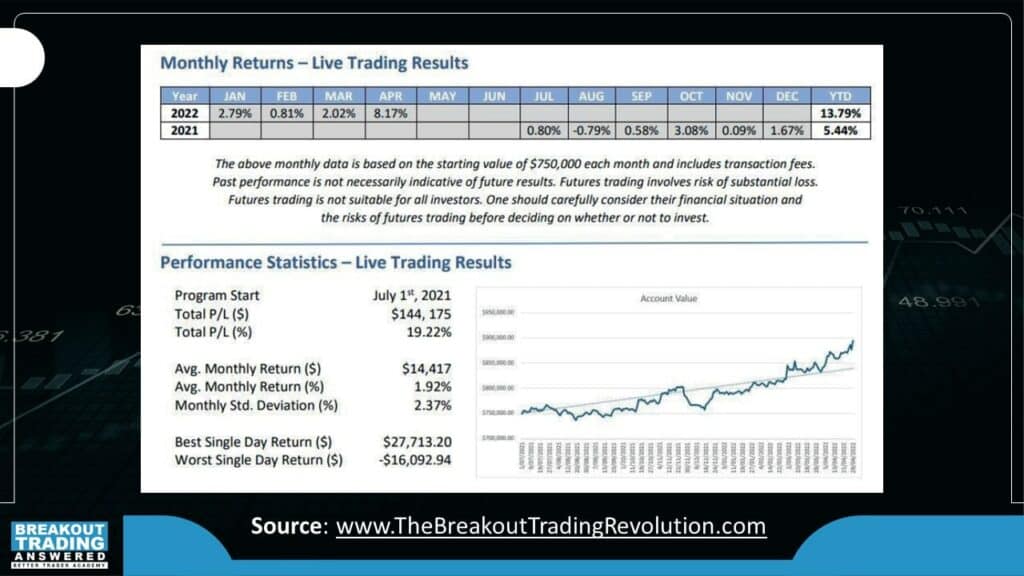

Of course the biggest proof of a proven model is if you share the model with other traders and they start having success with it as well.

That’s how you know you have a proven model.

In “The Breakout Trading Revolution” book, we have a lot of successful case studies and examples. They are real people, with real examples, like this one (audited results).

The breakout trading model has been proven on a lot of different markets.

Most traders trade the US markets and maybe some European markets, however the model has been used to trade markets around Asia as well. Hong Kong, Singapore, Japan and the Australian Futures markets.

In the book, we also have examples from Scandinavian markets. We have examples from Russian markets. So with this model, other traders are using it and sharing their results with us.

The model works on almost anything, which is amazing. And it’s simple.

So I think that really goes to show that it’s universal.

Next steps

If you want to learn more about the breakout trading model hundreds of traders are now using and how you can too, grab your copy of the Breakout Trading Revolution book (plus a bunch of awesome bonuses) at: https://thebreakouttradingrevolution.com

Watch the replay

Also, you can watch the entire live show replay where algorithmic breakout trading specialists Tomas Nesnidal and Andrew Swanscott discuss “How To Stop Losing Money – WINNING TRADING MODEL”, including:

- The difference between a trading model and a strategy,

- Why it’s important to have a model first (and why no model usually means losing money),

- How to create a trading model and determine if it’s good or not,

- A super simple breakout trading model you can use to build unlimited trading strategies,

- And much more.

Episode Highlights:

[00:58] Introduction

[04:43] The difference between a trading model and strategy

[10:28] Why having no model usually means losing money

[12:43] Creating a trading model you can use again and again

[14:26] How to identify if you have a good model

[21:43] Super simple breakout trading model

[27:43] Backtesting a model with no optimizable parameters

[30:23] The importance of focus in trading

Released: September 6, 2022