I have to admit, I used to be one of those traders who worked for months on a single trading strategy.

And I tried hard to make it “perfect”.

And then, when I launched it….. Boooom. It often didn’t work in live trading.

I think many traders relate to this. The neverending effort to develop at least one really good strategy. The ever-present doubts if the strategy is really a good one. And often with the disappointment once the strategy is launched.

But here is a bizarre truth I had to learn the hard way:

The ultimate edge is NOT in the strategy.

Let me repeat that:

The ultimate edge is NOT in the trading strategy.

It is in the ROBUSTNESS PROCEDURE.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

The only measurement of a potentially viable trading strategy is if tough robustness testing procedures say so. It’s not the time you spend building your trading strategy. It’s not its simplicity or complexity. It’s not even the “rationale” behind the trading strategy.

The only thing that really matters is the outcome of the robustness procedure (which needs to be extraordinarily tough, basic tests aren’t enough any more).

This was a HUGE paradigm shift for me.

But once I went through this crucial “aha” moment, instead of looking for an edge in trading strategies, I started looking for an edge in the robustness testing procedures.

And it changed everything.

Because if THIS robustness procedure works, then it alone will take care of the strategy-edge (by clearly and quantifiably finding which of the many strategy candidates is the one with an edge).

It’s simple. It’s logical.

Yet, it often takes traders too much time to fully realize and embrace this trading truth. I think we all become too infected with the many cliches and “false truths” we keep seeing in trading books and forums (especially at the beginning of our trading journey). But don’t forget – the vast majority of traders are NOT making money, at least on a consistent basis. So it’s always wise to question as many of these “false truths” as possible. Start thinking about the “next-level”, what’s beyond these “false truths”.

Today, I spend very little time with strategy building. The whole strategy building process is fully automated (and based on my breakout model – you can find more in this free online workshop). But a lot of time is constantly put into robustness testing. That’s where my real edge is.

My advice is – don’t waste time doing things that are unnecessary.

Keep your focus on where it is truly required.

Happy robustness testing.

Tomas

P.S.

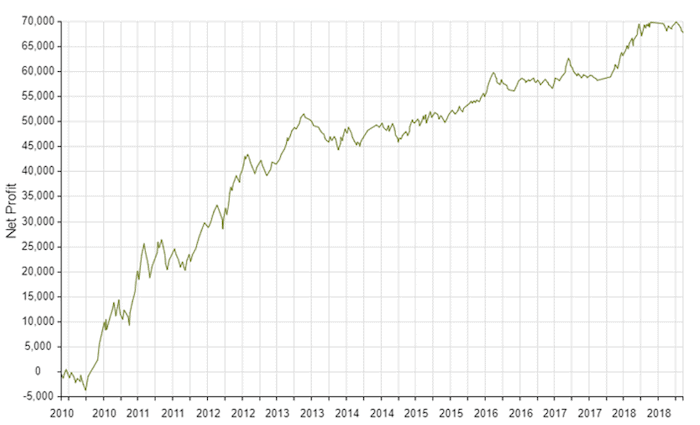

I believe that extraordinary robustness testing procedures are what makes me different to other traders. It’s also the main and absolutely essential difference between my Breakout Masterclass (where I cover the exact robustness procedures we use) and all the other “general” solutions. That’s also why the masterclass is bringing great results to many traders – if you haven’t watched it yet, here is the latest video success story.

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.

![[VIDEO] How to SURVIVE the coming crisis](https://bettertraderacademy.com/wp-content/uploads/2019/08/12.aug-FI-min.png)

![[VIDEO] How Lawyer Brian made +25,592 USD in live trading in the first 5 months](https://bettertraderacademy.com/wp-content/uploads/2019/09/brian1.2-min.png)