It’s a comment that comes up from time to time:

“Not sure I can trust you and the methodology presented. I am looking to learn how to trade options consistently and profitably and am looking for a trusted and credible mentor with a proven track record of success. I’ve already wasted by hard earned money on 1 subscription and now very hesitant to do it again unless the trust factor is 100% there. Thanks”

I’m not exactly sure who sent us this comment, but he/she raises a really good question:

How do we know who to trust online and who is full of crap?

It may sound like a difficult question but the answer is actually quite simple:

Assume EVERYONE is full of crap until proven otherwise.

Yes, even me, Tomas, Bob and everyone else at BTA.

- Don’t believe someone just because they share photos of a successful lifestyle of expensive cars, holidays, watches, wads of cash, etc – you’d be surprised how many people have a nice car (or rent one) but struggle to pay the bills,

- Don’t believe someone just because they’ve won a trading competition – most trading competitions encourage reckless trading and are won by a few over-leveraged trades that are more luck than skill, and definitely not the way to trade if you want to survive long-term,

- Don’t believe someone just because they’ve published trading statements or results online – any average $5 per hour graphic designer on a freelancing website can doctor a trading statement in a couple of minutes,

- Don’t believe someone just because they have pages and pages of testimonials – Testimonials can be (and often are) faked and exaggerated,

- Don’t believe someone just because they’ve won awards – lots of awards are really based on popularity and not trading skill, traders with big followings get their fans to vote for them so they win the awards,

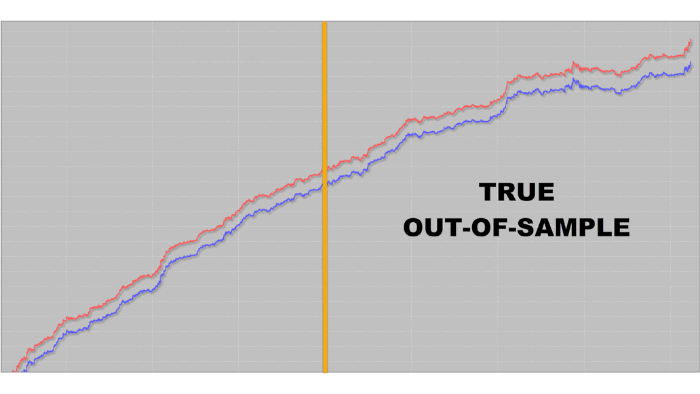

- Don’t believe someone just because they publish backtest reports – it’s pretty easy to over-optimize a trading strategy to produce a nice backtest report, but that doesn’t mean the strategy will work in live trading,

- Don’t believe someone just because they have a website/blog/podcast/social media or a fan of groupies who worship the ground they walk on – there are a lot of websites/podcasts out there run by people who can’t/don’t even trade (I know because I’ve spoken with quite a few of them),

- And I could go on but you get the point…

We’ve just ruled out EVERY trader on the planet, including everyone at BTA.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

So, how can you tell who and what you can believe?

Well, there’s a simple answer to that as well:

Application.

It’s the single most powerful way to prove if someone is genuine or just full of crap.

So, do you want to know if we’re full of it at BTA?

That’s simple.

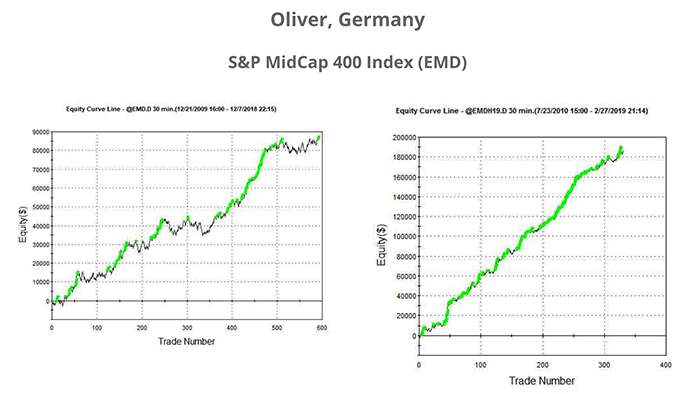

Take the stuff we share for free on the website, podcast, and ebooks and apply it to your own trading. (This free algo trading ebook is a great place to start – it’s packed with tips for traders of all levels, from beginner to advanced.)

Did it work?

No?

Then don’t get anything from us.

Move on and save your dollars for someone else. Seriously.

Because there are many people our stuff DOESN’T work for:

- People who are stuck in a traditional mindset and are afraid to try something new,

- People who have already made up their minds that something won’t work before they even try it (especially traders who think they ‘know it all’ and are out to prove others wrong to satisfy their own egos),

- People who are afraid to take action or are perfectionists,

- People who are in love with the idea and excitement of trading but deep down don’t really want to be traders,

- People who want to blame others for their trading results instead of taking full responsibility for their actions.

These people are much better off going somewhere else.

But, what if our stuff did work?

Well, then keep using whatever knowledge and techniques you’ve gained, and if it makes financial sense, check out some more advanced trainings and implement what’s in there too.

And guess what?

You can apply these exact same criteria to anyone.

But the key point is:

Don’t trust anyone.

Everyone is guilty until proven innocent.

That’s the approach I take (after being scammed a few times early in my trading career), and it’s saved me lots of time and money over the long-run.

You should do the same too.

Happy trading,

Andrew

![[VIDEO] A crisis might be coming and I’m excited](https://bettertraderacademy.com/wp-content/uploads/2019/01/7.jan2-min.png)

![[VIDEO] How to boost trading profits](https://bettertraderacademy.com/wp-content/uploads/2019/03/4mar19.png)

![[VIDEO] If you’re not trading gold, you’re missing out](https://bettertraderacademy.com/wp-content/uploads/2019/04/5apr19-min.png)

![[VIDEO] 71 life-changing trading tips for FREE](https://bettertraderacademy.com/wp-content/uploads/2019/05/20may-min.png)

![[VIDEO] Fully harness your trading power](https://bettertraderacademy.com/wp-content/uploads/2019/06/24jun19-min.png)