And during that time, two of my biggest weapons of mass financial abundance were Maximum Adverse Excursion (MAE) analysis and Maximum Favorable Excursion (MFE) analysis.

Both are very simple concepts.

In the first case (MAE), you take a certain entry type and look at the statistical distribution to find out the average of how much the position goes against you first, before getting its full momentum and riding up to the profit zone. Then, based on this MAE result, you can:

| 1. | Figure out the best stop-loss size, |

| 2. | Figure out when it is a good opportunity to add another contract. (Yes, it can sometimes be a really great idea to add a contract to your position when in a small open loss). |

In the case of MFE, you do the same – just from the opposite side. You analyze the statistical odds of different sized moves in your favor. And then use this information to figure out:

| 1. | The right Profit Target, |

| 2. | Another exit technique to get you out of profit at the best time, |

| 3. | When it’s a good time to scale out of your position a little. |

MAE/MFE analysis were always at the very core of my discretionary trading (even more important than the entry techniques itself) and definitely a huge part of my success.

So of course, when I moved to algo-trading, I took all of my MAE/MFE know-how with me and started applying it there too.

Unfortunately, I soon realized that algo-trading is way more complicated. My MAE/MFE ‘secret’ was not such a big thing anymore and I realized that in algo-trading, one really needs to keep pushing the limits constantly to make it work. Yes, new and fresh ideas are crucial and it’s very hard to succeed without them.

So, I had to really push myself and develop lots of new concepts and techniques in my algo-trading to achieve my goals.

And one of those concepts were….

the MAXIMUM FAVORABLE MARKET (MFM) analysis.

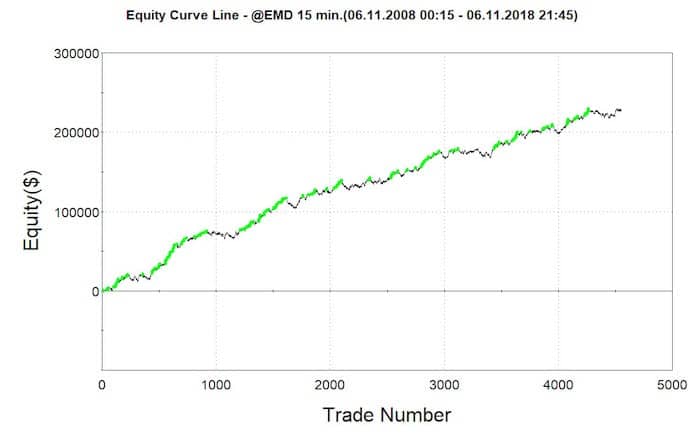

For me, the Maximum Favorable Market is a certain market configuration where everything is SIGNIFICANTLY BETTER aligned for more potential success than normal.

That doesn’t necessarily mean it’s a market configuration in which you might have a higher Win%. (Besides, profitable trading doesn’t have much to do with Win% until you introduce the Risk-Reward-Ratio too).The Maximum Favorable Market can simply be a certain market configuration where the overall market VOLUME is significantly stronger in a certain direction. Or it could be when the ratio between the long-traded stocks vs the short-traded stocks is unusually high – thus potentially producing very interesting and FAVORABLE conditions for certain kinds of trades. (Or it can be many other conditions too – but I think you have the idea now).

And then, the Maximum Favorable Market analysis is simply a set of tools and rules, which will tell me very precisely WHEN the Maximum Favorable Market configuration is happening – thus I can consider things like increasing positions, reducing / exiting existing positions that are trading in the opposite direction, trading certain types of signals only, or to not trade at all.

The last one (knowing when NOT trading at all) is especially important.

It can be super helpful and can save you thousands, perhaps tens of thousands of dollars if applied well. (I also call this as a ‘Super-filter’, because it is.)

Now, what techniques do I use to assess the Maximum Favorable Markets and build a super-filter to maximize my gains and minimize my losses and drawdowns?

I’ve done an extraordinary amount of research on this topic during my trading career and for indexes, stocks, and potentially energy and gold trading, I consistently see that the best techniques to use are based on Market Internals.

Even Maxim Schulz, the 3rd place winner in the 2017 World Cup Trading Championship used them to achieve his brilliant results (the same way I use them and teach them), saying:

“This year I’m much better than I was one year ago because of the Trading Market Internals. This was for me very, very important to improve myself. I’m more confident in trading, especially in trading stock indexes.”

– Maxim Schulz, the 3rd place winner in World Cup Trading Championship

So put simply, Market Internals and Maximum Favorable Market concepts do work.

And I recommend you check out what they can really do right here.

Happy trading!

Tomas

Sick of long and painful drawdowns?

✓ 5-step framework you can use right away to improve your trading performance

✓ 5-step framework you can use right away to improve your trading performance

✓ A proven solution to slash drawdowns by up to 50%

✓ Applicable for index futures, stocks, and ETFs

✓ Quick and easy to implement

✓ You get the strategy code, so you can do it yourself!