The real, Malaysian jungle, where I spent 3 days, together with spiders, snakes, monitor lizards, elephants, monkeys and other similar company.

Although I didn’t have any direct encounters with dangerous animals (just constantly stumbling on elephant poo), their presence could be sensed everywhere.

Our jungle guide was constantly monitoring every tree, every plant, every rustle in the bushes, with his sharp and well-trained eyes.

We never knew where the next King Cobra or Malaysian Tiger could be hiding, both of which are home in the Malaysian jungle.

The jungle guide repeated to us many times:

“The fact that you don’t see any danger right now doesn’t mean it’s not there”.

'The fact you don’t see any danger in the markets doesn’t mean it’s not there.' Click To Tweet

And I really loved this statement, because I think the same applies to trading:

“The fact you don’t see any danger in the markets doesn’t mean it is not there”.

This was certainly the attitude of many market participants up until a few weeks ago, with no consideration of the potential dangers in the market.

Many traders didn’t think about the possible risks when things were going so well.

Some even believed their luck would last forever.

But the hidden dangers were exposed, as they always do (eventually).

And that’s ok, because that’s how we learn and keep becoming better traders. That used to be my case as well until I got burned several times and I finally learned an important lesson which I then converted into a golden rule:

If things are going extremely well in the markets, work on your risk management more than ever.

'If things are going extremely well in the markets, work on your risk management more than ever.' Click To Tweet

Period.

Stop thinking you’re a genius that has figured the market out, and start thinking about what could possibly happen to your trading account if everything starts going wrong.

Start figuring out how you could protect your trading account, and do it before it’s too late.

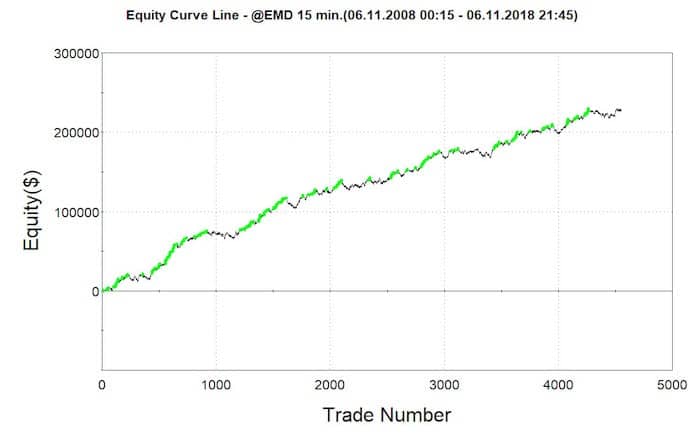

This is exactly how I developed some of my best Market Internals ‘drawdown protection’ techniques and methods.

In the fantastic days of constant wins I simply swapped pride for fear. Fear of the hidden danger just around the corner, the hidden danger that I can’t see… yet…

So learn from this recent market lesson, think of the jungle, be alert and always be prepared.

Keep working on your risk management and drawdowns, whatever is happening in the markets. That’s the best way to make sure you stay in the trading game for a long, long time.

And keep in mind:

“The fact that you don’t see any danger right now doesn’t mean it’s not there”.

Happy trading!

Tomas

P.S.

The Trading Market Internals techniques have also been cleverly utilized by Max Schultz, who came 3rd place in the 2017 World Cup Trading Championship. It helped him stay ahead of the game, as it has been helping me for many years as well.

Sick of long and painful drawdowns?

✓ 5-step framework you can use right away to improve your trading performance

✓ A proven solution to slash drawdowns by up to 50%

✓ Applicable for index futures, stocks, and ETFs

✓ Quick and easy to implement

✓ You get the strategy code, so you can do it yourself!